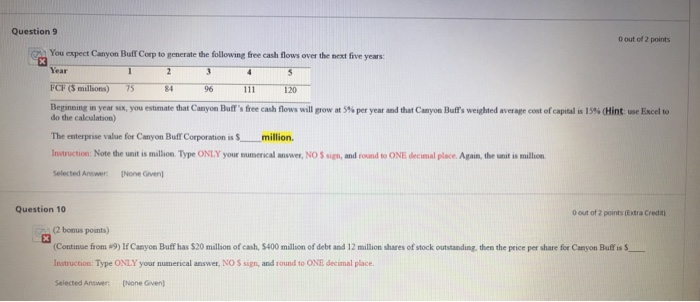

Question: please answer question #10 Question 9 out of 2 pots You expect Canyon Buff Corp to penerate the following free cash flows over the next

Question 9 out of 2 pots You expect Canyon Buff Corp to penerate the following free cash flows over the next five years Year FCF (5 millions) 75 84 96 111 Beginning in year sex, you estimate that Chryon Buff free cash flows will grow at 5% per year and that Canyon Buff's weighted average cost of capital is 154 (Hint use Excel to do the calculation) The enterprise value for Canyon Buff Corporation is $_ million Instruction: Note the unit is million Type ONLY your numerical wwer, NO Sign, and found to ONE decimal place. Again, the unit is million Selected Answer: None Given Question 10 Dout of 2 points tra Credit bonus points) (Cost from 9) I Canyon Buff has $20 million of cash, 5400 million of debt and 12 million shares of stock out Instruction Type ONLY your numerical wwer, NO S andro ONE decimal place there the price pershare for Canyon Buff is $_ Selected Answer phone Given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts