Question: please answer question 14 and 15 for the machine on 31 December 2017. This was longer than usual credit terms. Assume a market-related interest rate

please answer question 14 and 15

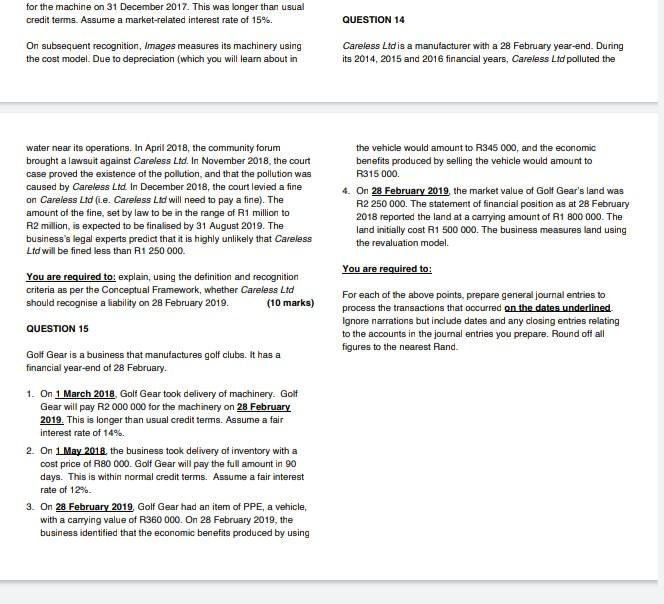

for the machine on 31 December 2017. This was longer than usual credit terms. Assume a market-related interest rate of 15%. QUESTION 14 On subsequent recognition, Images measures its machinery using the cost model. Due to depreciation (which you will learn about in Careless Ltd is a manufacturer with a 28 February year-end. During its 2014, 2015 and 2016 financial years, Careless Ltd polluted the water near its operations. In April 2018, the community forum brought a lawsuit against Careless Ltd. In November 2018, the court case proved the existence of the pollution, and that the pollution was caused by Careless Ltd. In December 2018, the court levied a fine on Careless Ltd (ie. Careless Ltd will need to pay a fine). The amount of the fine, set by law to be in the range of R1 million to R2 million, is expected to be finalised by 31 August 2019. The business's legal experts predict that it is highly unlikely that Careless Ltd will be fined less than R1 250 000 the vehicle would amount to R345 000, and the economic benefits produced by selling the vehicle would amount to R315 000 4. On 28 February 2019, the market value of Golf Gear's land was R2 250 000. The statement of financial position as at 28 February 2018 reported the land at a carrying amount of R1 800 000. The land initially cost R1 500 000. The business measures land using the revaluation model. You are required to: For each of the above points, prepare general journal entries to process the transactions that occurred on the dates underlined Ignore narrations but include dates and any closing entries relating to the accounts in the journal entries you prepare. Round off all figures to the nearest Rand You are required to explain, using the definition and recognition criteria as per the Conceptual Framework, whether Careless Ltd should recognise a liability on 28 February 2019. (10 marks) QUESTION 15 Golf Gear is a business that manufactures golf clubs. It has a financial year-end of 28 February 1. On 1 March 2018. Golf Gear took delivery of machinery. Golf Gear will pay R2 000 000 for the machinery on 28 February 2019. This is longer than usual credit terms. Assume a fair interest rate of 14%. 2. On 1 May 2018. the business took delivery of inventory with a cost price of R80 000. Golf Gear will pay the full amount in 90 days. This is within normal credit terms. Assume a fair interest rate of 12% 3. On 28 February 2019. Golf Gear had an item of PPE, a vehicle, with a carrying value of R360 000. On 28 February 2019, the business identified that the economic benefits produced by using for the machine on 31 December 2017. This was longer than usual credit terms. Assume a market-related interest rate of 15%. QUESTION 14 On subsequent recognition, Images measures its machinery using the cost model. Due to depreciation (which you will learn about in Careless Ltd is a manufacturer with a 28 February year-end. During its 2014, 2015 and 2016 financial years, Careless Ltd polluted the water near its operations. In April 2018, the community forum brought a lawsuit against Careless Ltd. In November 2018, the court case proved the existence of the pollution, and that the pollution was caused by Careless Ltd. In December 2018, the court levied a fine on Careless Ltd (ie. Careless Ltd will need to pay a fine). The amount of the fine, set by law to be in the range of R1 million to R2 million, is expected to be finalised by 31 August 2019. The business's legal experts predict that it is highly unlikely that Careless Ltd will be fined less than R1 250 000 the vehicle would amount to R345 000, and the economic benefits produced by selling the vehicle would amount to R315 000 4. On 28 February 2019, the market value of Golf Gear's land was R2 250 000. The statement of financial position as at 28 February 2018 reported the land at a carrying amount of R1 800 000. The land initially cost R1 500 000. The business measures land using the revaluation model. You are required to: For each of the above points, prepare general journal entries to process the transactions that occurred on the dates underlined Ignore narrations but include dates and any closing entries relating to the accounts in the journal entries you prepare. Round off all figures to the nearest Rand You are required to explain, using the definition and recognition criteria as per the Conceptual Framework, whether Careless Ltd should recognise a liability on 28 February 2019. (10 marks) QUESTION 15 Golf Gear is a business that manufactures golf clubs. It has a financial year-end of 28 February 1. On 1 March 2018. Golf Gear took delivery of machinery. Golf Gear will pay R2 000 000 for the machinery on 28 February 2019. This is longer than usual credit terms. Assume a fair interest rate of 14%. 2. On 1 May 2018. the business took delivery of inventory with a cost price of R80 000. Golf Gear will pay the full amount in 90 days. This is within normal credit terms. Assume a fair interest rate of 12% 3. On 28 February 2019. Golf Gear had an item of PPE, a vehicle, with a carrying value of R360 000. On 28 February 2019, the business identified that the economic benefits produced by using

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts