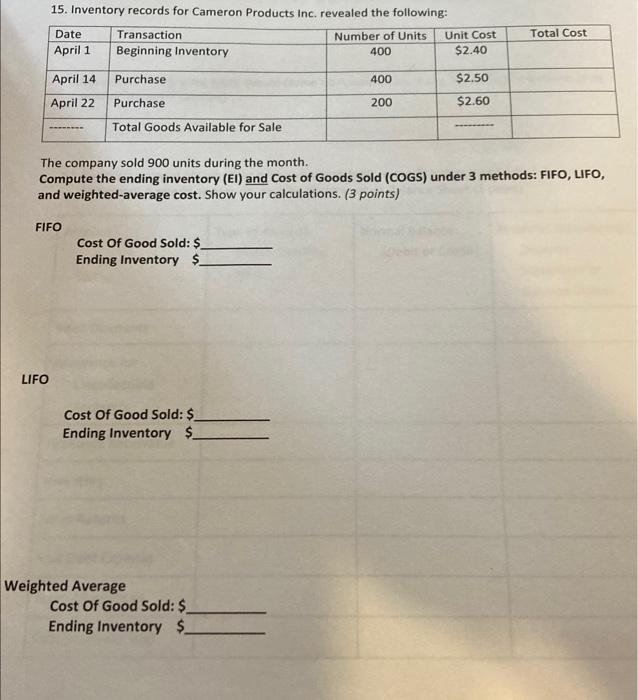

Question: Please answer question 15, 16, 17 15. Inventory records for Cameron Products Inc. revealed the following: The company sold 900 units during the month. Compute

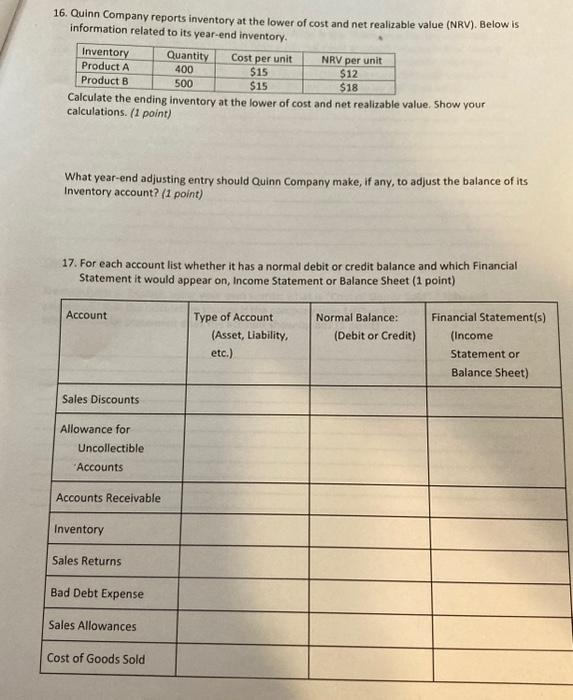

15. Inventory records for Cameron Products Inc. revealed the following: The company sold 900 units during the month. Compute the ending inventory (EI) and Cost of Goods Sold (COGS) under 3 methods: FIFO, LIFO, and weighted-average cost. Show your calculations. ( 3 points) FIFO Cost Of Good Sold: $ Ending Inventory LIFO Cost Of Good Sold: $ Ending Inventory \$ Weighted Average Cost Of Good Sold: $ Ending Inventory $ 16. Quinn Company reports inventory at the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Caicunate tne ending inventory at the lower of cost and net realizable value. Show your calculations. ( 1 point) What year-end adjusting entry should Quinn Company make, if any, to adjust the balance of its Inventory account? ( 1 point) 17. For each account list whether it has a normal debit or credit balance and which Financial Statement it would appear on, Income Statement or Balance Sheet ( 1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts