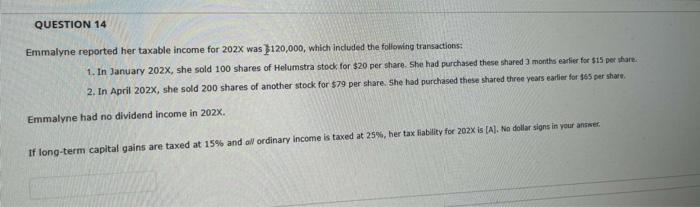

Question: please answer question 15 and please show work, thank you! :) Emmalyne reported her taxable income for 202X was $120,000, which included the following transactions:

Emmalyne reported her taxable income for 202X was $120,000, which included the following transactions: 1. In January 202x, she sold 100 shares of Helumstra stock for $20 per stare. She had purchased these shared 3 months earlicr for $15 per thare: 2. In April 202X, she sold 200 shares of another stock for $79 per share. she had purchased these shared three years earlier for 355 ser shav. Emmalyne had no dividend income in 202x. If long-term capital gains are taxed at 15% and all ordinary income is taxed at 25%, her tax fablity for 202x is [A]. Nia dollar sions in your ansise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts