Question: please answer question 16.22. Thank you Capital Structure Policy 16.22 Two theories of capital structure: Use the information in the following table to make a

please answer question 16.22. Thank you

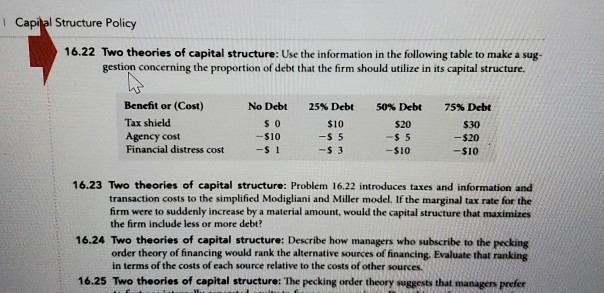

Capital Structure Policy 16.22 Two theories of capital structure: Use the information in the following table to make a sug. gestion concerning the proportion of debt that the firm should utilize in its capital structure, Benefit or (Cost) Tax shield Agency cost Financial distress cost No Debt SO -- $10 -$! 25% Debt $10 -$ 5 -$ 3 50% Debt $20 -$ 5 -$10 75% Debt $30 -$20 -$10 16.23 Two theories of capital structure: Problem 16.22 introduces taxes and information and transaction costs to the simplified Modigliani and Miller model. If the marginal tax rate for the firm were to suddenly increase by a material amount would the capital structure that maximizes the firm include less or more debt? 16.24 Two theories of capital structure: Describe how managers who subscribe to the pecking order theory of financing would rank the alternative sources of financing. Evaluate that ranking in terms of the costs of each source relative to the costs of other sources. 16.25 Two theories of capital structure: The pecking order theory suggests that managers prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts