Question: Please answer. Question 2 (10 marks) PPW Corp. is expected to have an EBIT of $1.50 million next year. Depreciation, the increase in net working

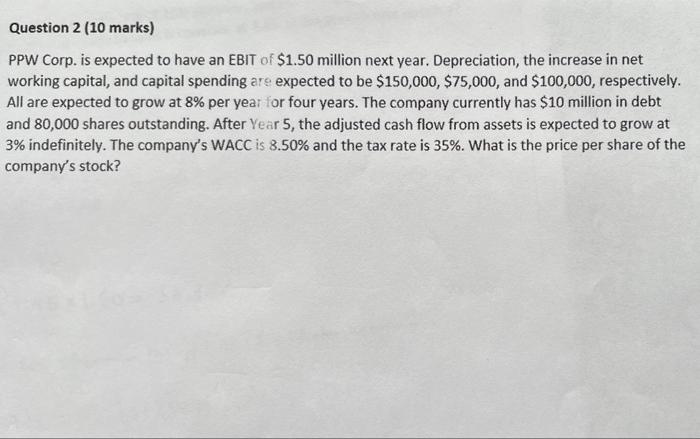

Question 2 (10 marks) PPW Corp. is expected to have an EBIT of $1.50 million next year. Depreciation, the increase in net working capital, and capital spending are expected to be $150,000, $75,000, and $100,000, respectively. All are expected to grow at 8% per year for four years. The company currently has $10 million in debt and 80,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3% indefinitely. The company's WACC is 8.50% and the tax rate is 35%. What is the price per share of the company's stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts