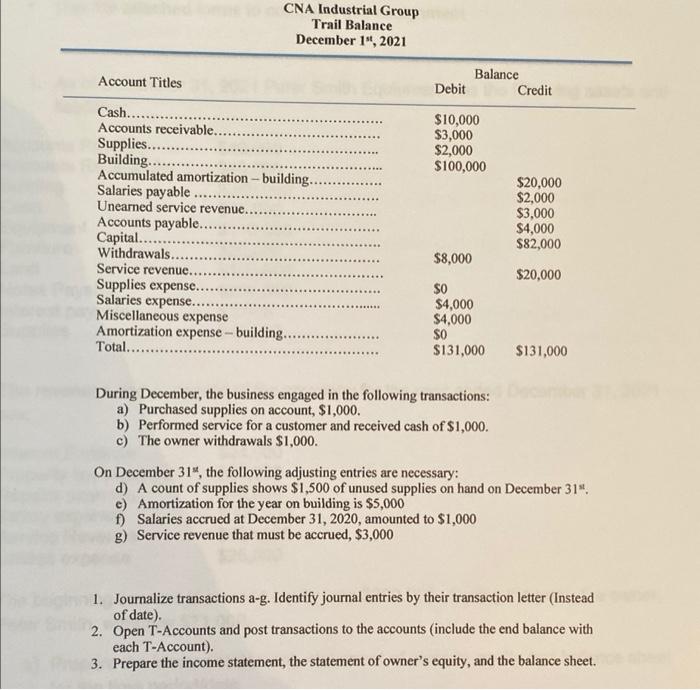

Question: Please answer question 2 & 3. CNA Industrial Group Trail Balance December 19, 2021 Account Titles Debit Balance Credit $10,000 $3,000 $2,000 $100,000 Cash.. Accounts

CNA Industrial Group Trail Balance December 19, 2021 Account Titles Debit Balance Credit $10,000 $3,000 $2,000 $100,000 Cash.. Accounts receivable. Supplies...... Building. Accumulated amortization - building, Salaries payable Unearned service revenue.. Accounts payable.. Capital...... Withdrawals.. Service revenue.. Supplies expense. Salaries expense. Miscellaneous expense Amortization expensebuilding.... Total....... $20,000 $2,000 $3,000 $4,000 $82,000 $8,000 $20,000 RE $0 $4,000 $4.000 SO $131,000 $131,000 During December, the business engaged in the following transactions: a) Purchased supplies on account, $1,000. b) Performed service for a customer and received cash of $1,000. c) The owner withdrawals $1,000. On December 31", the following adjusting entries are necessary: d) A count of supplies shows $1,500 of unused supplies on hand on December 31 e) Amortization for the year on building is $5,000 ) Salaries accrued at December 31, 2020, amounted to $1,000 g) Service revenue that must be accrued, $3,000 1. Journalize transactions a-g. Identify journal entries by their transaction letter (Instead of date). 2. Open T-Accounts and post transactions to the accounts (include the end balance with each T-Account). 3. Prepare the income statement, the statement of owner's equity, and the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts