Question: please answer question #2 A corporation enters into a $10 million notional principal interest rate swap. The swap calls for the firm to pay a

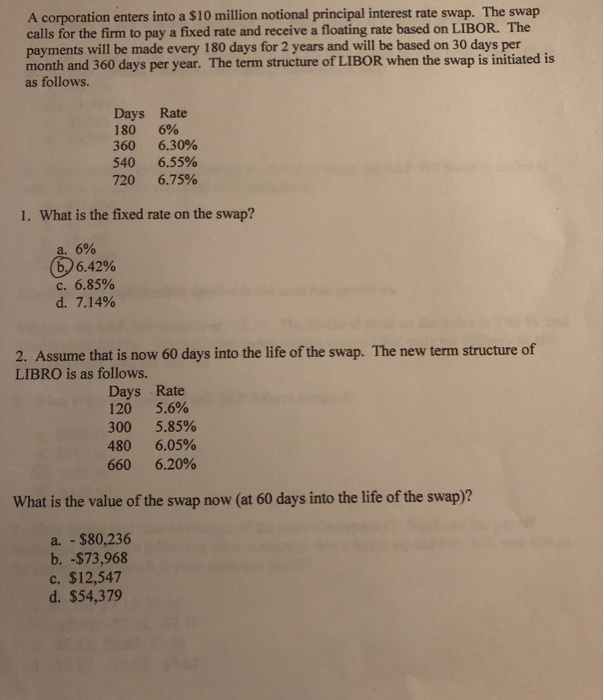

A corporation enters into a $10 million notional principal interest rate swap. The swap calls for the firm to pay a fixed rate and receive a floating rate based on LIBOR. The payments will be made every 180 days for 2 years and will be based on 30 days per month and 360 days per year. The term structure of LIBOR when the swap is initiated is as follows Days Rate 180 6% 360 6.30% 540 6.55% 720 6.75% 1. What is the fixed rate on the swap? 6% a. (b) 6.42% c. 6.85% d. 7.14% 2. Assume that is now 60 days into the life of the swap. The new term structure of LIBRO is as follows. Days Rate 120 5.6% 300 5.85% 480 6.05% 660 6.20% What is the value of the swap now (at 60 days into the life of the swap)? a. - $80,236 b. -$73,968 c. $12,547 d. $54,379

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts