Question: Please answer question 2: Compute the capital acquisitions ratio. 2. Compute the capital acquisitions ratio. (Round your answer to 2 decimal places.) Capital acquisitions ratio

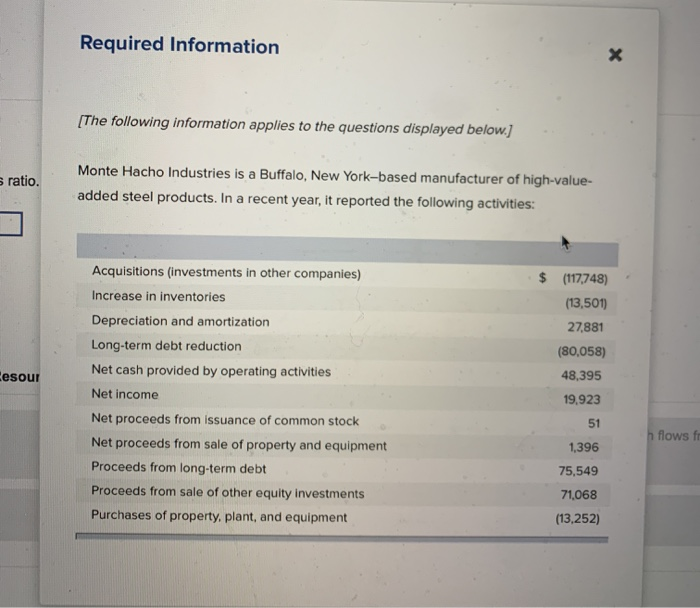

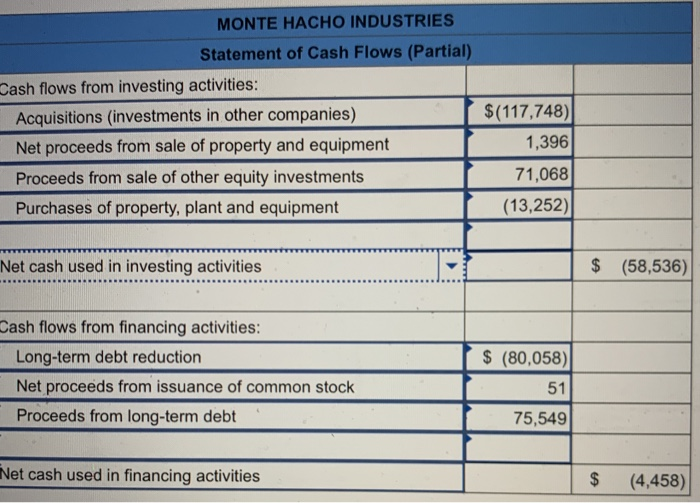

2. Compute the capital acquisitions ratio. (Round your answer to 2 decimal places.) Capital acquisitions ratio References eBook & Resources Worksheet Learning Objective: 12-04 Report and interpret cash flows from investing activities. Leaming Objective: 12-06 Repo activities. Difficulty: 3 Hard Learning Objective: 12-05 Analyze and interpret the capital acquisitions ratio. Check my work Required Information [The following information applies to the questions displayed below.) s ratio. Monte Hacho Industries is a Buffalo, New York-based manufacturer of high-value- added steel products. In a recent year, it reported the following activities: $ Acquisitions (investments in other companies) Increase in inventories Depreciation and amortization Long-term debt reduction Net cash provided by operating activities Net income Net proceeds from Issuance of common stock Net proceeds from sale of property and equipment Proceeds from long-term debt Proceeds from sale of other equity investments Purchases of property, plant, and equipment (117,748) (13,501) 27.881 (80,058) 48,395 19,923 Cesour 51 h flows fo 1,396 75,549 71,068 (13,252) MONTE HACHO INDUSTRIES Statement of Cash Flows (Partial) Cash flows from investing activities: Acquisitions (investments in other companies) Net proceeds from sale of property and equipment ( Proceeds from sale of other equity investments Purchases of property, plant and equipment $(117,748) 1,396 71,068 (13,252) Net cash used in investing activities $ (58,536) Cash flows from financing activities: Long-term debt reduction Net proceeds from issuance of common stock Proceeds from long-term debt. $ (80,058) 51 75,549 Net cash used in financing activities $ (4,458)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts