Question: Please answer question 2 Required: a: From the information above calculate for 31 December 20X1 the following ratios: 1. Debt to Equity ratio if. Earnings

Please answer question 2

Please answer question 2

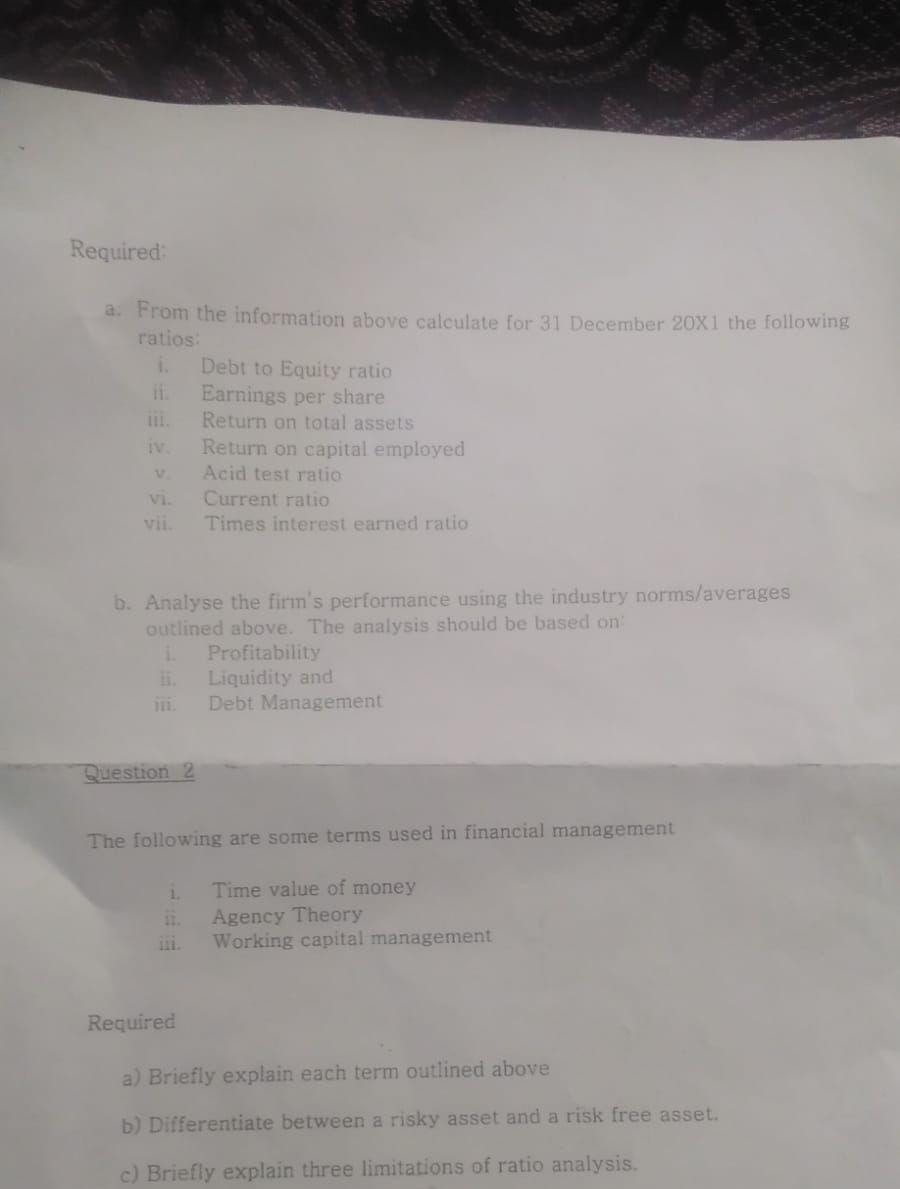

Required: a: From the information above calculate for 31 December 20X1 the following ratios: 1. Debt to Equity ratio if. Earnings per share Return on total assets iv. Return on capital employed Acid test ratio Current ratio Times interest earned ratio b. Analyse the firm's performance using the industry norms/averages outlined above. The analysis should be based on 1. Profitability Liquidity and Debt Management Question 2 The following are some terms used in financial management 1. Time value of money Agency Theory Working capital management Required a) Briefly explain each term outlined above b) Differentiate between a risky asset and a risk free asset. c) Briefly explain three limitations of ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts