Question: Please answer question 2 since Question 1 has been answered. Assignment questions for the Role of Capital Market Intermediaries in the Dot-Com Crash of 2000

Please answer question 2 since Question 1 has been answered. Assignment questions for the Role of Capital Market Intermediaries in the Dot-Com Crash of 2000 1. List all the major players that play an intermediation role between individual investors and entrepreneurs/managers. What is the intended function of each of the intermediaries? 2. How is each of the intermediaries you identified compensated for performing its respective function? Is the compensation arrangement likely to lead any dysfunctional incentives? 3. Identify the role each intermediary might have played in the creation of the dot-com bubble. Was this behavior related to the potential dysfunctional behavior identified in question 2? 4. How do you fix these problems?

Question 1 provide last time

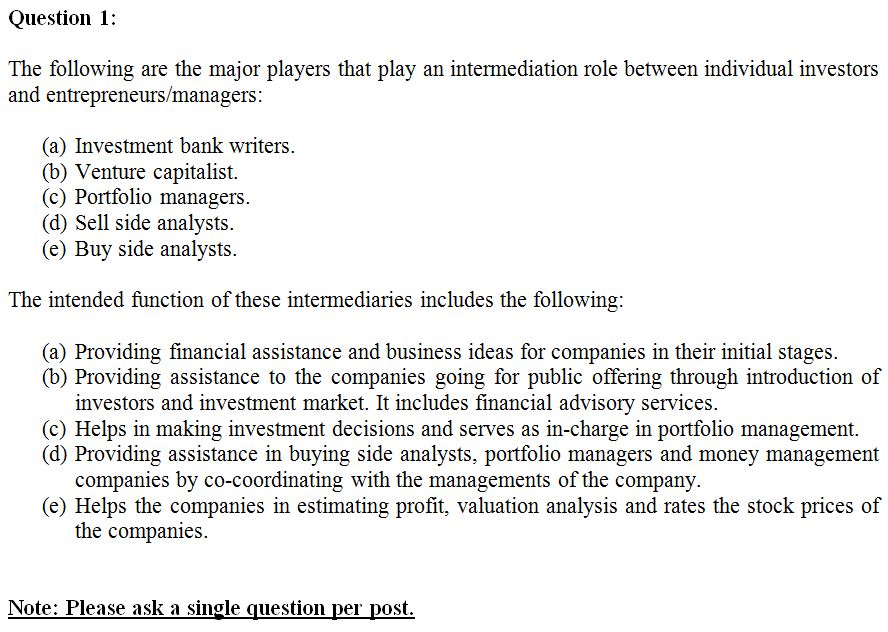

Question 1: The following are the major players that play an intermediation role between individual investors and entrepreneurs/managers: (a) Investment bank writers. (b) Venture capitalist. (c) Portfolio managers. (d) Sell side analysts. (e) Buy side analysts. The intended function of these intermediaries includes the following: (a) Providing financial assistance and business ideas for companies in their initial stages. b) Providing assistance to the companies going for public offering through introduction of investors and investment market. It includes financial advisory services. (c) Helps in making investment decisions and serves as in-charge in portfolio management. (d) Providing assistance in buying side analysts, portfolio managers and money management companies by co-coordinating with the managements of the company (e) Helps the companies in estimating profit, valuation analysis and rates the stock prices of the companies. Note: Please ask a single question per post

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts