Question: please answer question 2 subparts II. Value at Risk Find the value at risk for different time horizons and confidence levels of a 1,000$ portfolio

please answer question 2 subparts

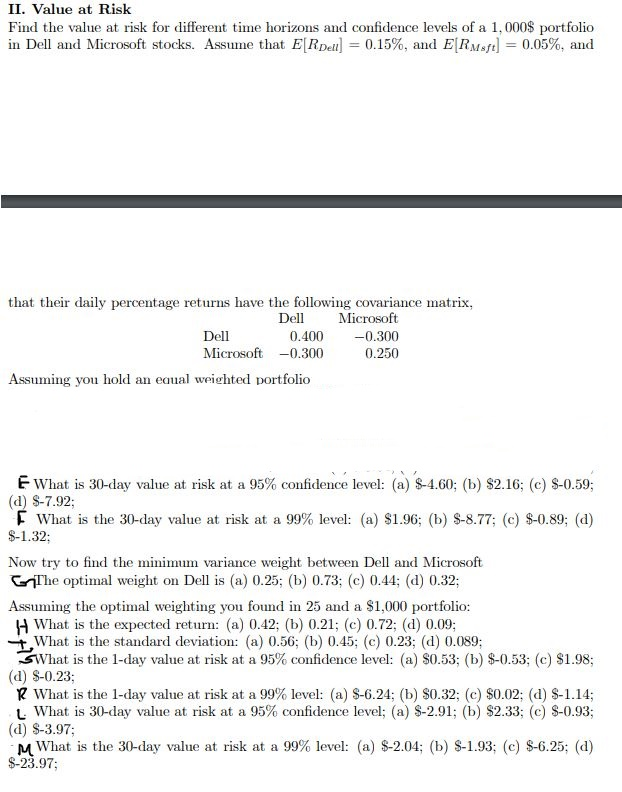

II. Value at Risk Find the value at risk for different time horizons and confidence levels of a 1,000$ portfolio in Dell and Microsoft stocks. Assume that ERDell-0.15%, and ERMaft-0.05%. and that their daily percentage returns have the following covariance matrix, Dell Microsoft0.300 Del Microsoft 0.400 -0.300 0.250 Assuming you hold an eaual weighted portfolio E What is 30-day value at risk at a 95% confidence level: (a) $4.60; (b) $2.16; (c) $-0.59 E What is the 30-day value at risk at a 99% level: (a) $1.96; (b) $-8.77; (c) $-0.89; (d) (d) S-7.92 $-1.32; Now try to find the minimum variance weight between Dell and Microsoft Assuming the optimal weighting you found in 25 and a S1,000 portfolio: The optimal weight on Dell is (a) 0.25; (b) 0.73; (c) 0.44; (d) 0.32; H What is the expected return: (a) 0.42; (b) 0.21 () 0.72; (d) 0.09: What is the standard deviation: (a) 0.56; (b) 0.45; (c) 0.23; (d) 0.089; SW hat is the 1-day value at risk at a 95% confidence level: (a) $0.53; (b) $0.53; (c) $1.98 (d) S-0.23 R What is the 1-day value at risk at a 99% level: (a) $-6.24; (b) $0.32; (c) $0.02; (d) $-1.14; u what is 30-day value at risk at a 95% confidence level; (a) $-2.91; (b) $2.33; (c) $-0.93 (d) S-3.97; M What is the 30-day value at risk at a 99% level: (a) $-2.04; (b) $-1.93; (c) 8-625; (d) $-23.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts