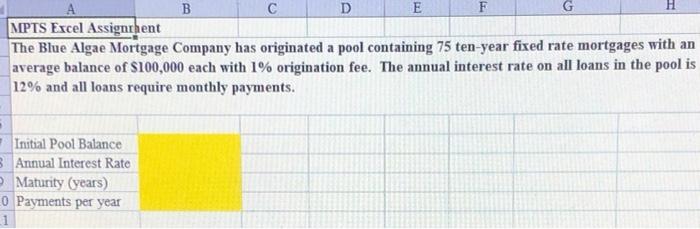

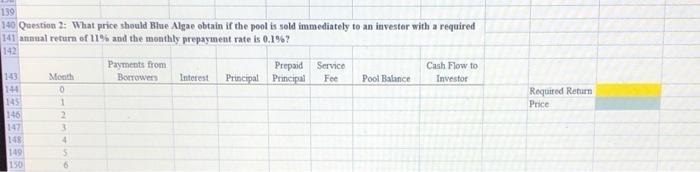

Question: please answer question 2 with excel functions! the highlighted cells need the formulas ud A D E F MPTS Excel Assignment The Blue Algae Mortgage

ud A D E F MPTS Excel Assignment The Blue Algae Mortgage Company has originated a pool containing 75 ten-year fixed rate mortgages with an average balance of $100,000 each with 1% origination fee. The annual interest rate on all loans in the pool is 12% and all loans require monthly payments. - Initial Pool Balance 3 Annual Interest Rate Maturity (years) 0 Payments per year 1 139 140 Question 2: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required 147 annual return of 1196 and the monthly prepayment rate is 0.1% 142 Payments from Borrowers Prepaid Principal Principal Service Fee Cash Flow to Investor Interest Pool Balance Required Return Price 144 12 146 147 118 149 150 Month 0 1 2 3 4 5 ud A D E F MPTS Excel Assignment The Blue Algae Mortgage Company has originated a pool containing 75 ten-year fixed rate mortgages with an average balance of $100,000 each with 1% origination fee. The annual interest rate on all loans in the pool is 12% and all loans require monthly payments. - Initial Pool Balance 3 Annual Interest Rate Maturity (years) 0 Payments per year 1 139 140 Question 2: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required 147 annual return of 1196 and the monthly prepayment rate is 0.1% 142 Payments from Borrowers Prepaid Principal Principal Service Fee Cash Flow to Investor Interest Pool Balance Required Return Price 144 12 146 147 118 149 150 Month 0 1 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts