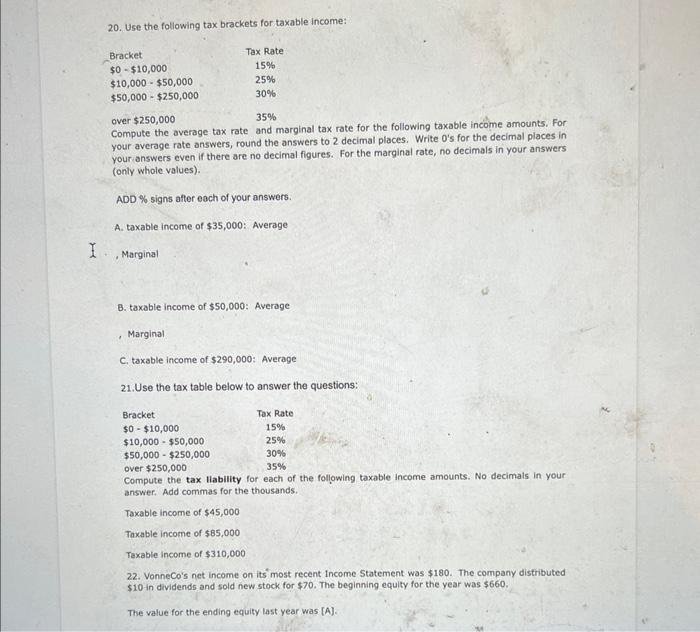

Question: please answer question 20, 21, and 22 thank you ! :) 20. Use the following tax brackets for taxable income: over $250,00035% Compute the average

20. Use the following tax brackets for taxable income: over $250,00035% Compute the average tax rate and marginal tax rate for the following taxable income amounts. For your average rate answers, round the answers to 2 decimal places. Write 0 's for the decimal places in your answers even if there are no decimal figures. For the marginal rate, no decimals in your answers (only whole values). ADD \% signs after each of your answers. A. taxable income of $35,000 : Average - Marginal B. taxable income of $50,000 : Average - Marginal C. taxable income of $290,000 : Average 21.Use the tax table below to answer the questions: Compute the tax liability for each of the following taxable income amounts. No decimals in your answer. Add commas for the thousands. Taxable income of $45,000 Taxable income of $85,000 Taxable income of $310,000 22. VonneCo's net income on its most recent income Statement was $180. The company distributed $10 in dividends and sold new stock for $70. The beginning equity for the year was $660. The value for the ending equity last year was [A]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts