Question: Please Answer Question 21 (20 points) A) ABC Inc. has $50,000 in average inventory, $60,000 in average receivables, and $101,000 in average payables. Last year's

Please Answer

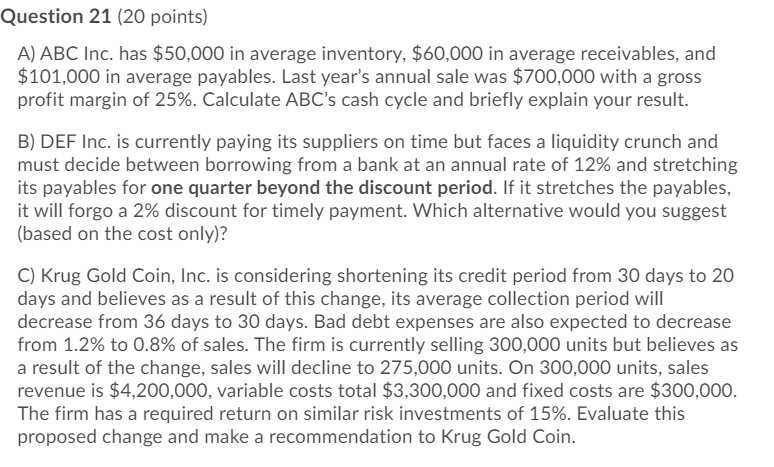

Question 21 (20 points) A) ABC Inc. has $50,000 in average inventory, $60,000 in average receivables, and $101,000 in average payables. Last year's annual sale was $700,000 with a gross profit margin of 25%. Calculate ABC's cash cycle and briefly explain your result. B) DEF Inc. is currently paying its suppliers on time but faces a liquidity crunch and must decide between borrowing from a bank at an annual rate of 12% and stretching its payables for one quarter beyond the discount period. If it stretches the payables, it will forgo a 2% discount for timely payment. Which alternative would you suggest (based on the cost only)? C) Krug Gold Coin, Inc. is considering shortening its credit period from 30 days to 20 days and believes as a result of this change, its average collection period will decrease from 36 days to 30 days. Bad debt expenses are also expected to decrease from 1.2% to 0.8% of sales. The firm is currently selling 300,000 units but believes as a result of the change, sales will decline to 275,000 units. On 300,000 units, sales revenue is $4,200,000, variable costs total $3,300,000 and fixed costs are $300,000. The firm has a required return on similar risk investments of 15%. Evaluate this proposed change and make a recommendation to Krug Gold Coin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts