Question: please answer question 24. 22. When we calculate the Value of a firm's operations at a future date, assuming grow at a constant rate from

please answer question 24.

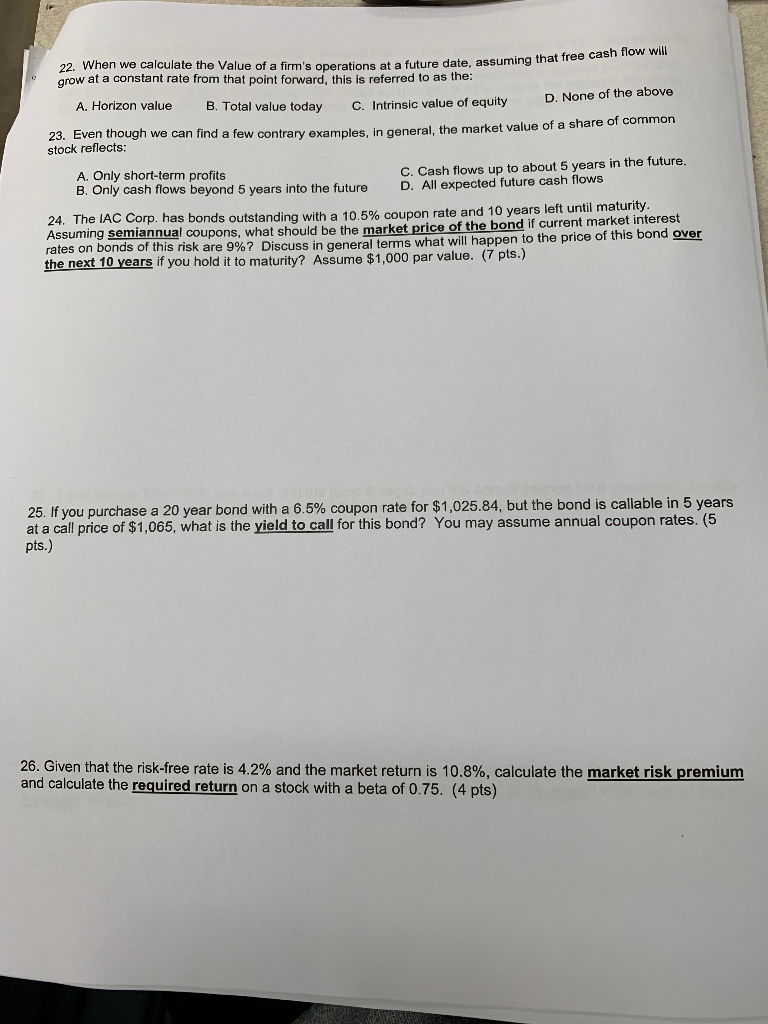

22. When we calculate the Value of a firm's operations at a future date, assuming grow at a constant rate from that point forward, this is referred to as the: that free cash flow will D. None of the above s, in general, the market value of a share of common C. Cash flows up to about 5 years in the future A. Horizon value B. Total value today C. Intrinsic value of equity Even though we can find a few contrary example 23. stock reflects: A. Only short-term profits B. O nly cash flows beyond 5 years into the future D. All expected future cash flows 24. The IAC Corp. Assuming semia rates on bonds of thi the next 10 years if you hold it to maturity? Assume $1,000 par value. (7 pts.) has bonds outstanding with a 10.5% coupon rate and 10 years left until maturity nnual coupons, what should be the market price of the bond if current market interest is risk are 9%? Discuss in general terms what will happen to the price of this bond over 25. If you purchase a 20 year bond with a 6.5% coupon rate for $1,025.84, but the bond is at a call price of $1,065, what is the yield to call for this b pts.) all ble in 5 years 26. Given that the risk-free rate is 4.2% and the market return is 10.8%, calculate the market risk premium and calculate the required return on a stock with a beta of 0.75. (4 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts