Question: please answer question 27 and 28 k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity 28. DuPont

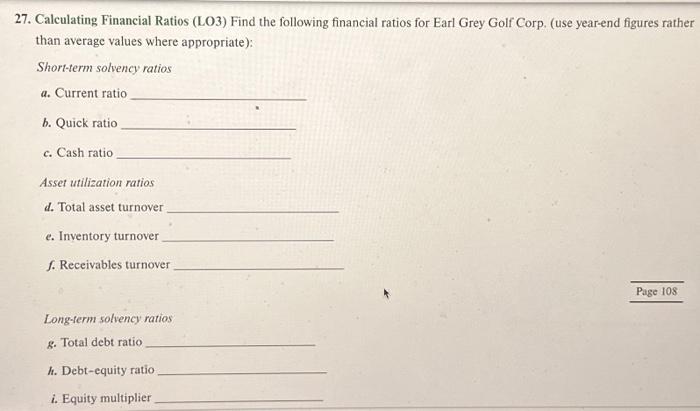

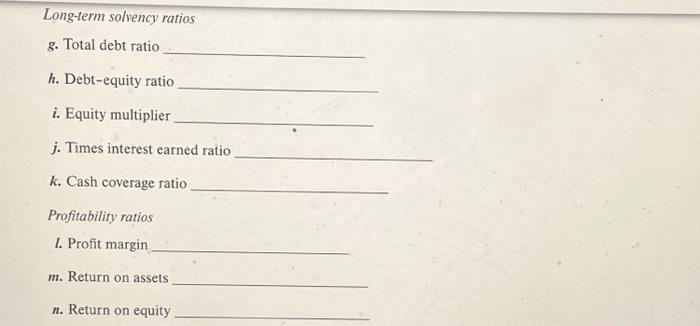

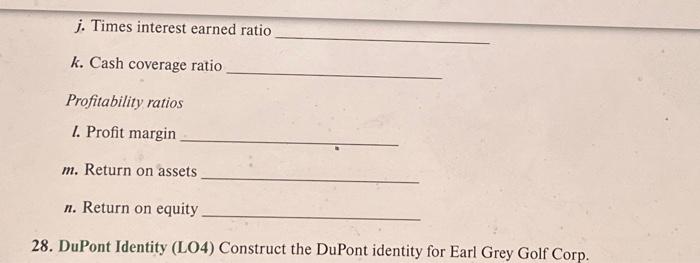

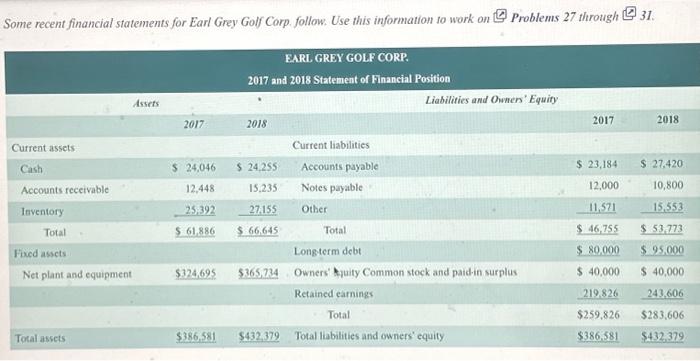

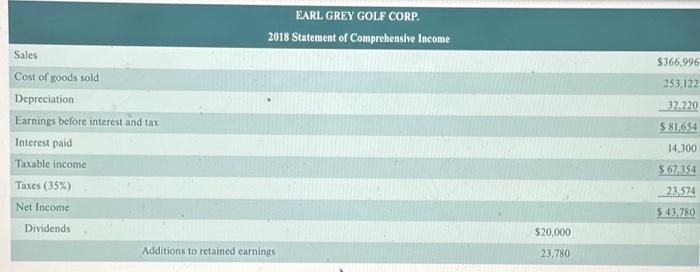

k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity 28. DuPont Identity (LO4) Construct the DuPont identity for Earl Grey Golf Corp. Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios l. Profit margin m. Return on assets n. Return on equity 7. Calculating Financial Ratios (LO3) Find the following financial ratios for Earl Grey Golf Corp. (use year-end figures rather than average values where appropriate): Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier Some recent financial statements for Earl Grey Golf Corp. follow. Use this information to work on Problems 27 through 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts