Question: Please answer question 2c&2d. Please show your work as well. Thank you! Show all your work. Round to 6 decimal places in the intermediate steps

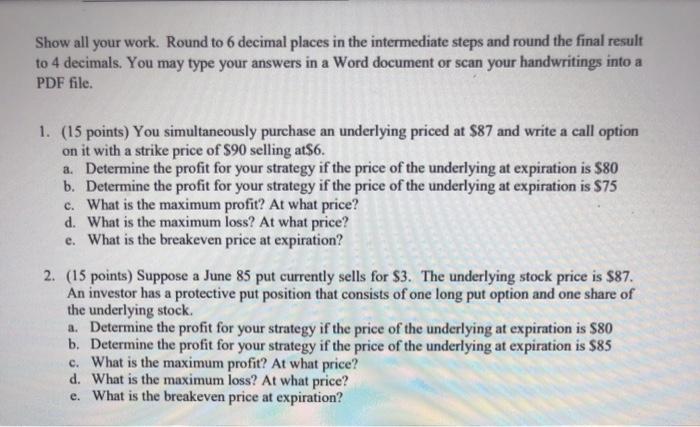

Show all your work. Round to 6 decimal places in the intermediate steps and round the final result to 4 decimals. You may type your answers in a Word document or scan your handwritings into a PDF file. 1. (15 points) You simultaneously purchase an underlying priced at $87 and write a call option on it with a strike price of $90 selling at$6. a. Determine the profit for your strategy if the price of the underlying at expiration is $80 b. Determine the profit for your strategy if the price of the underlying at expiration is $75 c. What is the maximum profit? At what price? d. What is the maximum loss? At what price? e. What is the breakeven price at expiration? 2. (15 points) Suppose a June 85 put currently sells for $3. The underlying stock price is $87. An investor has a protective put position that consists of one long put option and one share of the underlying stock. a. Determine the profit for your strategy if the price of the underlying at expiration is $80 b. Determine the profit for your strategy if the price of the underlying at expiration is $85 c. What is the maximum profit? At what price? d. What is the maximum loss? At what price? e. What is the breakeven price at expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts