Question: Please answer question 3 and 4 Question 3 (10 points) If the return on stock A in year 1 was 5 %, in year 2

Please answer question 3 and 4

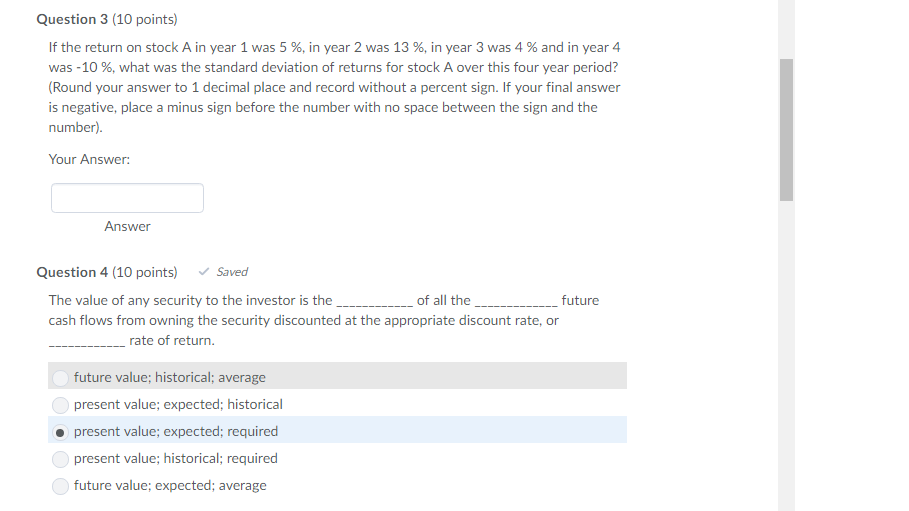

Question 3 (10 points) If the return on stock A in year 1 was 5 %, in year 2 was 13 %, in year 3 was 4 % and in year 4 was-10 %, what was the standard deviation of returns for stock A over this four year period? Round your answer to 1 decimal place and record without a percent sign. If your final answer is negative, place a minus sign before the number with no space between the sign and the number). Your Answer: Answer Question 4 (10 points) Saved The value of any security to the investor is the cash flows from owning the security discounted at the appropriate discount rate, on of all the future rate of return future value; historical; average present value; expected; historical o present value; expected; required present value; historical; required future value; expected; average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts