Question: Please answer question 3 Each contract is for 5,000 bushels. Ignoring interest, what are the bakery's gains or losses from futures position? 3) The forward

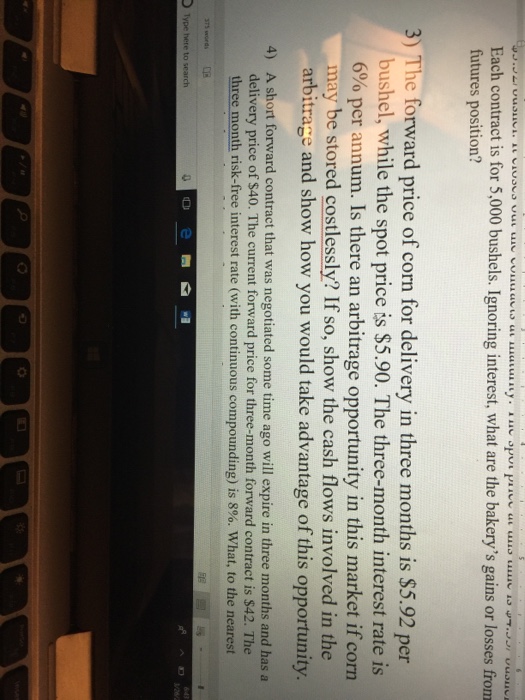

Each contract is for 5,000 bushels. Ignoring interest, what are the bakery's gains or losses from futures position? 3) The forward price of corn for delivery in three months is S5.92 per bushel, while the spot price is $5.90. The three-month interest rate is 6% per annum. Is there an arbitrage opportunity in this market ifcom may be stored costlessly? If so, show the cash flows involved in the arbitrage and show how you would take advantage of this opportunity. A short forward contract that was negotiated some time ago will expire in three months and has a delivery price of $40. The current forward price for three-month forward contract is $42. The three month risk-free interest rate (with continuous compounding) is 800, what, to the nearest 4) Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts