Question: Please answer Question 3 in 3ai) 3aii) 3b) 3c) format! Thanks. Please write answer in bulk for each question please. Please answer to best of

Please answer Question 3 in 3ai) 3aii) 3b) 3c) format! Thanks. Please write answer in bulk for each question please. Please answer to best of your ability. Thanks. Will give good rating.

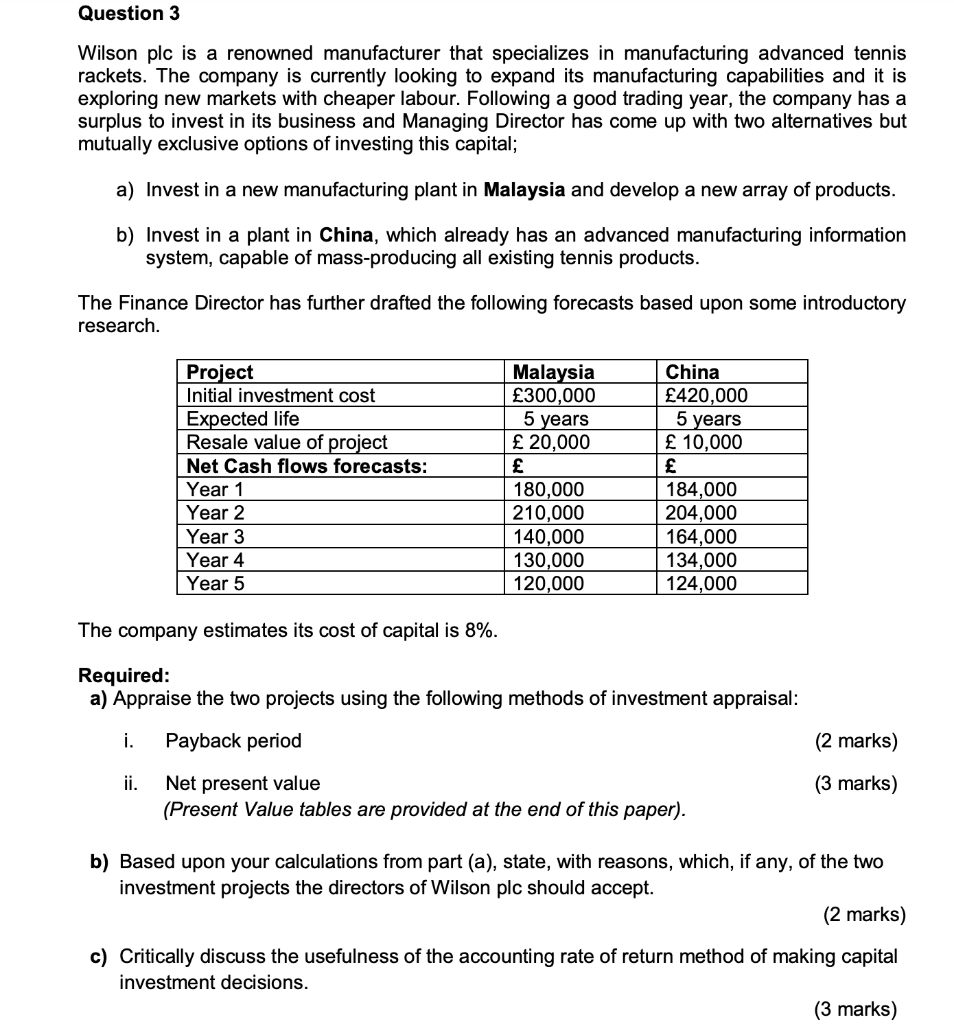

Question 3 Wilson plc is a renowned manufacturer that specializes in manufacturing advanced tennis rackets. The company is currently looking to expand its manufacturing capabilities and it is exploring new markets with cheaper labour. Following a good trading year, the company has a surplus to invest in its business and Managing Director has come up with two alternatives but mutually exclusive options of investing this capital; a) Invest in a new manufacturing plant in Malaysia and develop a new array of products. b) Invest in a plant in China, which already has an advanced manufacturing information system, capable of mass-producing all existing tennis products. The Finance Director has further drafted the following forecasts based upon some introductory research. Project Initial investment cost Expected life Resale value of project Net Cash flows forecasts: Year 1 Year 2 Year 3 Year 4 Year 5 Malaysia 300,000 5 years 20,000 180,000 210,000 140,000 130,000 120,000 China 420,000 5 years 10,000 184,000 204,000 164,000 134,000 124,000 The company estimates its cost of capital is 8%. Required: a) Appraise the two projects using the following methods of investment appraisal: i. Payback period (2 marks) ii. (3 marks) Net present value (Present Value tables are provided at the end of this paper). b) Based upon your calculations from part (a), state, with reasons, which, if any, of the two investment projects the directors of Wilson plc should accept. (2 marks) c) Critically discuss the usefulness of the accounting rate of return method of making capital investment decisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts