Question: Please answer question 3 part b (i & ii) 3. Spartans Investment House is an underwriting firm specializing in initial public offerings (IPOs). Spartans is

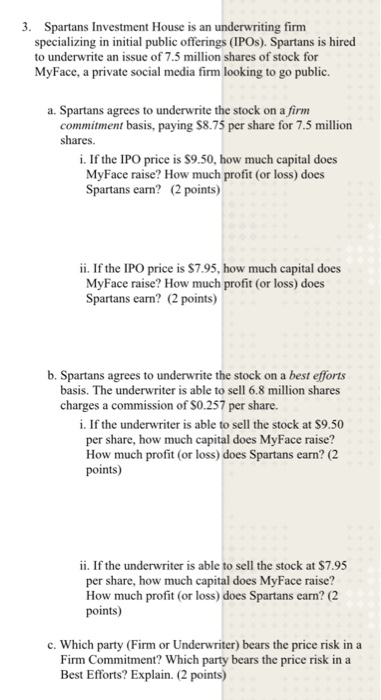

3. Spartans Investment House is an underwriting firm specializing in initial public offerings (IPOs). Spartans is hired to underwrite an issue of 7.5 million shares of stock for MyFace, a private social media firm looking to go public a. Spartans agrees to underwrite the stock on a firm commitment basis, paying $8.75 per share for 7.5 million shares. i. If the IPO price is S9.50, how much capital does MyFace raise? How much profit (or loss) does Spartans earn? (2 points) ii. If the IPO price is S7.95, how much capital does MyFace raise? How much profit (or loss) does Spartans earn? (2 points) b. Spartans agrees to underwrite the stock on a best efforts basis. The underwriter is able to sell 6.8 million shares charges a commission of S0.257 per share. i. If the underwriter is able to sell the stock at $9.50 per share, how much capital does MyFace raise? How much profit (or loss) does Spartans earn? (2 points) ii. If the underwriter is able to sell the stock at $7.95 per share, how much capital does MyFace raise? How much profit (or loss) does Spartans earn? (2 points) c. Which party (Firm or Underwriter) bears the price risk in a t? Which party bears the price risk in a Firm Commitment Best Efforts? Explain. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts