Question: please answer question 3. Thank you. ogramming Sensitivity Analysis CASE STUDY Coastal States Chemicals and Fertilizers In December 2005, Bill Stock, general manager for the

please answer question 3. Thank you.

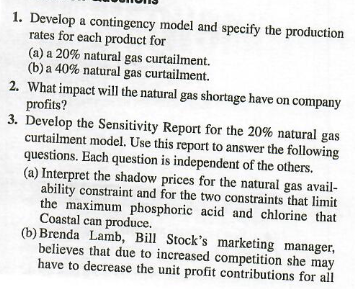

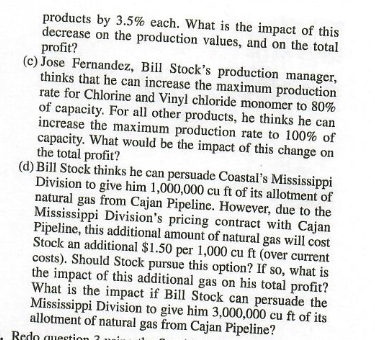

ogramming Sensitivity Analysis CASE STUDY Coastal States Chemicals and Fertilizers In December 2005, Bill Stock, general manager for the Louisiana Division of Coastal States Chemicals and Fertilizers, received a letter from Pred McNair of the Cajan Pipeline Company, which notified Coastal States that priorities had been established for the allocation of natural gas. The letter stated that Cajan Pipeline, the primary supplier of natural gas to Coastal States, might be instructed to curtail natural gas supplies to its industrial and commercial customers by as much as 40% during the ensuing winter months. Moreover, Cajan Pipeline had the approval of the Federal Power Commission (FPC) to curtail such supplies. Possible curtailment was attributed to the priorities estab- lished for the use of natural gas First priority: residential and commercial heating Second priority: commercial and industrial users that use natural gas as a source of raw material Third priority: commercial and industrial users whereby natural gas is used as boiler fuel Almost all of Coastal States' uses of natural gas were in the second and third priorities. Hence, its plants were certainly subject to brownouts, or natural gas curtailments. The occurrence and severity of the brownouts depended on a number of complex fac- tors. First, Cajan Pipeline was part of an interstate transmission network that delivered natural gas to residential and commercial buildings on the Atlantic coast and in northeastern regions of the United States. Hence, the severity of the forthcoming winter in these regions would have a direct impact on the use of natural gas. Second, the demand for natural gas was soaring because it was the cleanest and most efficient fuel. There were almost no environmental problems in burning natural gas. Moreover, main- tenance problems due to fuel-fouling in fireboxes and boilers were negligible with natural gas systems. Also, burners were much easier to operate with natural gas than with oil or coal. Finally, the supply of natural gas was dwindling. The tradi- tionally depressed price of natural gas had discouraged new exploration for gas wells, hence, shortages appeared imminent. Stock and his staff at Coastal States had been aware of the possibility of shortages of natural gas and had been investigat- ing ways of converting to fuel oil or coal as a substitute for nat- ural gas. Their plans, however, were still in the developmental stages. Coastal States required an immediate contingency plan to minimize the effect of a natural gas curtailment on its multi- plant, operations. The obvious question was, what operations should be curtailed, and to what extent could the adverse effect upon profits be minimized? Coastal States had approval from the FPC and Cajan Pipeline to specify which of its plants would bear the burden of the curtailment if such cutbacks were neces- sary. McNair, of Cajan Pipeline, replied, "It's your "pie': we don't care how you divide it if we make it smaller." The Model Six plants of Coastal States Louisiana Division were to share in the "pie." They were all located in the massive Baton Rouge- Geismar-Gramercy industrial complex along the Mississippi River between Baton Rouge and New Orleans. Products manu- factured at those plants that required significant amounts of natural gas were phosphoric acid, urea, ammonium phosphate, ammonium nitrate, chlorine, caustic soda, vinyl chloride monomer, and hydrofluoric acid. Stock called a meeting of members of his technical staff to discuss a contingency plan for allocation of natural gas among the products if a curtailment developed. The objective was to minimize the impact on profits. After detailed discussion, the meeting was adjourned. Two weeks later, the meeting recon- vened. At this session, the data in Table 4.3 were presented. Coastal States' contract with Cajan Pipeline specified maximum natural gas consumption of 36,000 cuftz 10 per day TABLE 4.3 Contribution to Profit and Overhead CONTRIBUTIN PERTONISI CAPACITY CIONS PER DAY MAXIMUM PRODUCTION RATE PERCENT ON CAPACITY) 80 PRODUCT Phosphoric acid Urca Ammonium Phosphate Ammonium nitrate Chlorine Caustic soda Vinyl chloride monomer Hydrofluoric acid 60 80 90 100 50 50 400 250 300 300 800 1,000 500 400 80 90 100 60 NATURAL GAS CONSUMPTION 11,000 CC FT PERTON 5.5 7.0 8.0 10.0 15.0 16.0 12.0 11.0 60 65 70 60 80 1. Develop a contingency model and specify the production rates for each product for (a) a 20% natural gas curtailment. (b) a 40% natural gas curtailment. 2. What impact will the natural gas shortage have on company profits? 3. Develop the Sensitivity Report for the 20% natural gas curtailment model. Use this report to answer the following questions. Each question is independent of the others. (a) Interpret the shadow prices for the natural gas avail- ability constraint and for the two constraints that limit the maximum phosphoric acid and chlorine that Coastal can produce. (b) Brenda Lamb, Bill Stock's marketing manager, believes that due to increased competition she may have to decrease the unit profit contributions for all products by 3.5% each. What is the impact of this decrease on the production values, and on the total profit? (c) Jose Fernandez, Bill Stock's production manager, thinks that he can increase the maximum production rate for Chlorine and Vinyl chloride monomer to 80% of capacity. For all other products, he thinks he can increase the maximum production rate to 100% of capacity. What would be the impact of this change on the total profit? (d) Bill Stock thinks he can persuade Coastal's Mississippi Division to give him 1,000,000 cu ft of its allotment of natural gas from Cajan Pipeline. However, due to the Mississippi Division's pricing contract with Cajan Pipeline, this additional amount of natural gas will cost Stock an additional $1.50 per 1,000 cu ft (over current costs). Should Stock pursue this option? If so, what is the impact of this additional gas on his total profit? What is the impact if Bill Stock can persuade the Mississippi Division to give him 3,000,000 cu ft of its allotment of natural gas from Cajan Pipeline? Redo amestion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts