Question: Please answer question 3, Thank you! Please answer the following question in regards to real estate finance ng Tol liesetlallsactiS 2. A residential rental property

Please answer question 3, Thank you!

Please answer the following question in regards to real estate finance

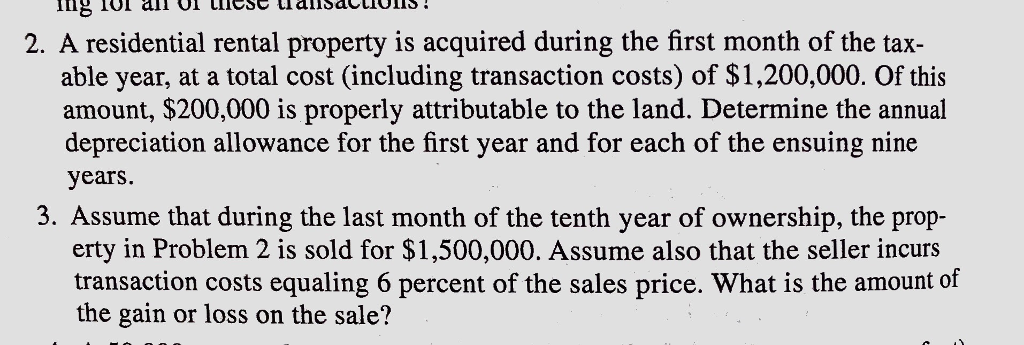

ng Tol liesetlallsactiS 2. A residential rental property is acquired during the first month of the tax- able year, at a total cost (including transaction costs) of $1,200,000. Of this amount, $200,000 is properly attributable to the land. Determine the annual depreciation allowance for the first year and for each of the ensuing nine years. 3. Assume that during the last month of the tenth year of ownership, the prop- erty in Problem 2 is sold for $1,500,000. Assume also that the seller incurs transaction costs equaling 6 percent of the sales price. What is the amount of the gain or loss on the sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts