Question: please answer question 33 & 34 only. zoom to see it clear. thanks in advance 33. Compute MACRS depreciation for the following qualified assets for

please answer question 33 & 34 only. zoom to see it clear. thanks in advance

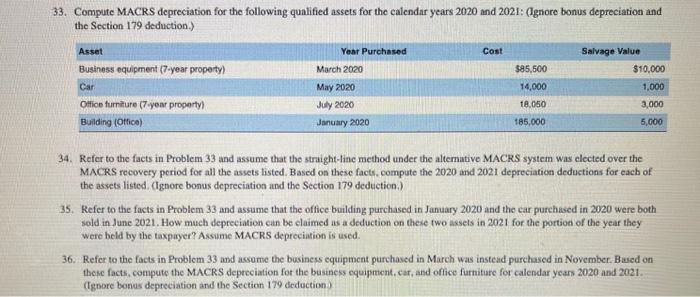

33. Compute MACRS depreciation for the following qualified assets for the calendar years 2020 and 2021: (Ignore bonus depreciation and the Section 179 deduction) Asset Year Purchased Cost Salvage Value Business equipment (7-year property) March 2020 $85,500 $10,000 May 2020 14,000 1,000 Office furniture (7-year property) July 2020 18.050 3,000 Building (Office) January 2020 185.000 5,000 Car 34. Refer to the facts in Problem 33 and assume that the straight-line method under the alternative MACRS system was elected over the MACRS recovery period for all the assets listed. Based on these facts, compute the 2020 and 2021 depreciation deductions for each of the assets listed (Ignore bonus depreciation and the Section 179 deduction) 35. Refer to the facts in Problem 33 and assume that the office building purchased in January 2020 and the car purchased in 2020 were both sold in June 2021. How much depreciation can be claimed as a deduction on these two assets in 2021 for the portion of the year they were held by the taxpayer? Assume MACRS depreciation is used. 36. Refer to the facts in Problem 33 and assume the business equipment purchased in March was instead purchased in November. Based on these facts, compute the MACRS depreciation for the business equipment.car, and office furniture for calendar years 2020 and 2021. (Ignore bonus depreciation and the Section 179 deduction 33. Compute MACRS depreciation for the following qualified assets for the calendar years 2020 and 2021: (Ignore bonus depreciation and the Section 179 deduction) Asset Year Purchased Cost Salvage Value Business equipment (7-year property) March 2020 $85,500 $10,000 May 2020 14,000 1,000 Office furniture (7-year property) July 2020 18.050 3,000 Building (Office) January 2020 185.000 5,000 Car 34. Refer to the facts in Problem 33 and assume that the straight-line method under the alternative MACRS system was elected over the MACRS recovery period for all the assets listed. Based on these facts, compute the 2020 and 2021 depreciation deductions for each of the assets listed (Ignore bonus depreciation and the Section 179 deduction) 35. Refer to the facts in Problem 33 and assume that the office building purchased in January 2020 and the car purchased in 2020 were both sold in June 2021. How much depreciation can be claimed as a deduction on these two assets in 2021 for the portion of the year they were held by the taxpayer? Assume MACRS depreciation is used. 36. Refer to the facts in Problem 33 and assume the business equipment purchased in March was instead purchased in November. Based on these facts, compute the MACRS depreciation for the business equipment.car, and office furniture for calendar years 2020 and 2021. (Ignore bonus depreciation and the Section 179 deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts