Question: please answer question 3,4,5,6 thank you very much 3. Identify the one true statement about political risk: (a) Political risk is defined as the risk

please answer question 3,4,5,6

thank you very much

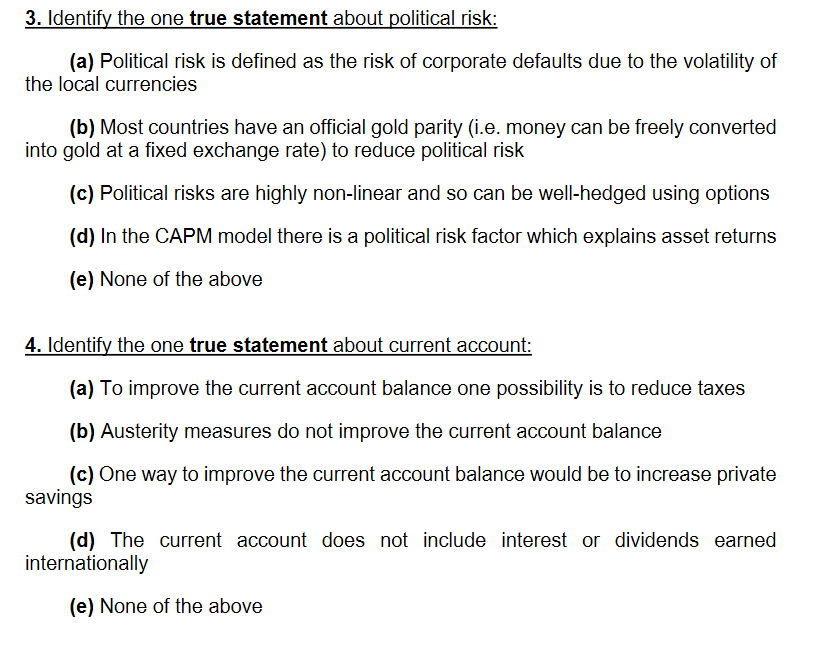

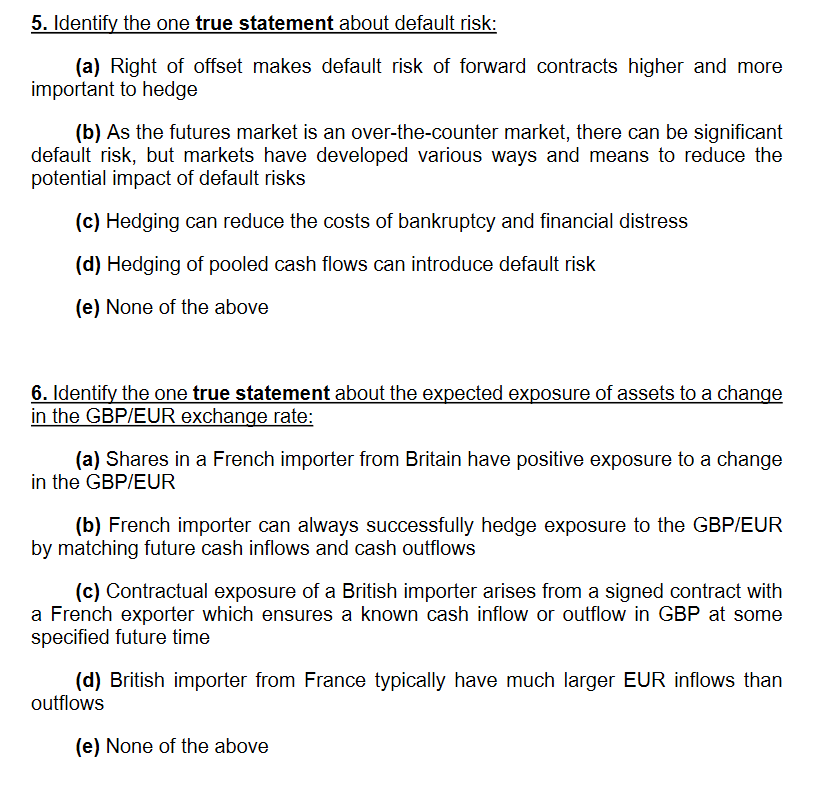

3. Identify the one true statement about political risk: (a) Political risk is defined as the risk of corporate defaults due to the volatility of the local currencies (b) Most countries have an official gold parity (i.e. money can be freely converted into gold at a fixed exchange rate) to reduce political risk (c) Political risks are highly non-linear and so can be well-hedged using options (d) In the CAPM model there is a political risk factor which explains asset returns (e) None of the above 4. Identify the one true statement about current account: (a) To improve the current account balance one possibility is to reduce taxes (b) Austerity measures do not improve the current account balance (c) One way to improve the current account balance would be to increase private savings (d) The current account does not include interest or dividends earned internationally (e) None of the above 5. Identify the one true statement about default risk: (a) Right of offset makes default risk of forward contracts higher and more important to hedge (b) As the futures market is an over-the-counter market, there can be significant default risk, but markets have developed various ways and means to reduce the potential impact of default risks (c) Hedging can reduce the costs of bankruptcy and financial distress (d) Hedging of pooled cash flows can introduce default risk (e) None of the above 6. Identify the one true statement about the expected exposure of assets to a change in the GBP/EUR exchange rate: (a) Shares in a French importer from Britain have positive exposure to a change in the GBP/EUR (b) French importer can always successfully hedge exposure to the GBP/EUR by matching future cash inflows and cash outflows (c) Contractual exposure of a British importer arises from a signed contract with a French exporter which ensures a known cash inflow or outflow in GBP at some specified future time (d) British importer from France typically have much larger EUR inflows than outflows (e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts