Question: Please answer question 4 & 5 QUESTIONS AND PROBLEMS 1. Assume analysts provide the following types of information. Assume (standard defi- nition) short sales are

Please answer question 4 & 5

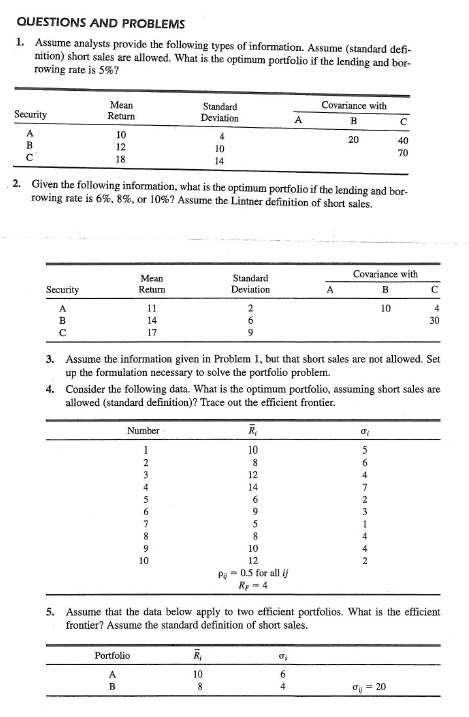

QUESTIONS AND PROBLEMS 1. Assume analysts provide the following types of information. Assume (standard defi- nition) short sales are allowed. What is the optimum portfolio if the lending and bor- rowing rate is 5%? Security Mean Return Standard Deviation Covariance with B A 20 A B 10 12 18 4 10 14 40 70 2. Given the following information, what is the optimum portfolio if the lending and bor- rowing rate is 6%, 8%, or 10%? Assume the Lintner definition of short sales. Mean Return Security Standard Deviation 2 Covariance with B A 10 A B 11 14 17 4 30 3. Assume the information given in Problem 1, but that short sales are not allowed. Set up the formulation necessary to solve the portfolio problem. 4. Consider the following data. What is the optimum portfolio, assuming short sales are allowed (standard definition)? Trace out the efficient frontier. Number 1 2 3 4 5 6 7 8 9 10 R 10 8 12 14 6 9 5 8 10 12 P = 0.5 for all i Ry - 4 5 6 4 7 2 3 1 4 5. Assume that the data below apply to two efficient portfolios. What is the efficient frontier? Assume the standard definition of short sales. Portfolio A B R 10 8 6 4 = 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts