Question: Please answer question 4-7. Thanks! FINA46000 - Assignment #1 September, 2019 Answer questions on a separate piece of paper. Show your work 1. A recent

Please answer question 4-7. Thanks!

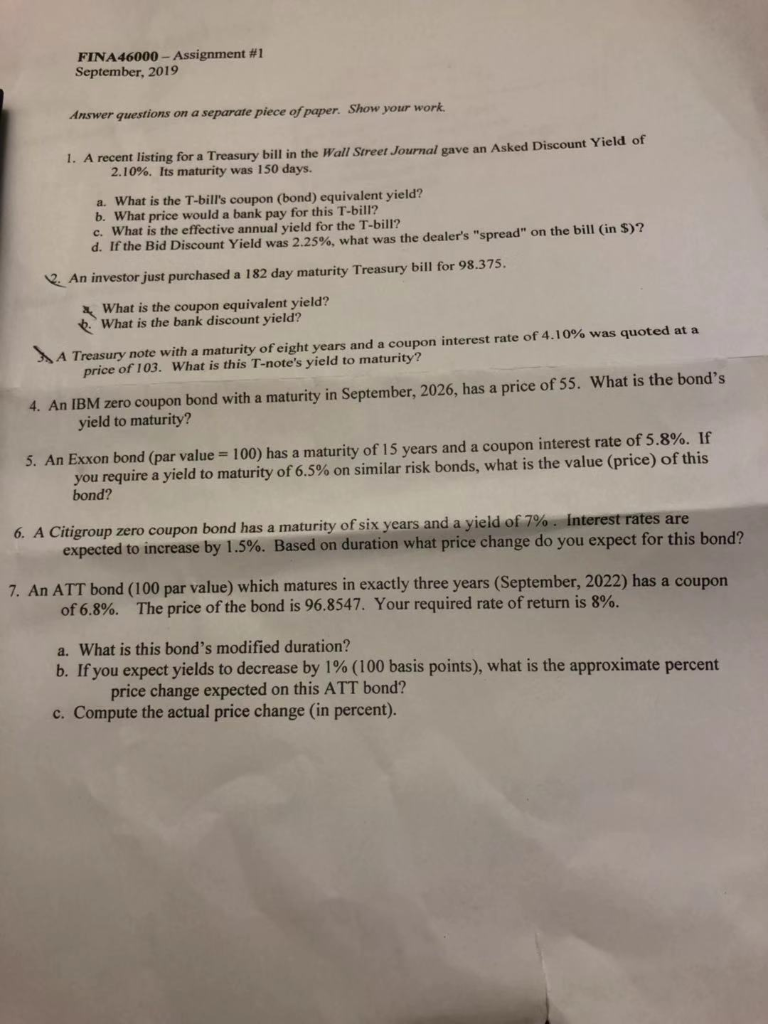

FINA46000 - Assignment #1 September, 2019 Answer questions on a separate piece of paper. Show your work 1. A recent listing for a Treasury bill in the Wall Street Journal gave an Asked Discount Yield of 2.10%. Its maturity was 150 days. a. What is the T-bill's coupon (bond) equivalent yield? b. What price would a bank pay for this T-bill? c. What is the effective annual yield for the T-bill? d. If the Bid Discount Yield was 2.25%, what was the dealer's "spread" on the bill (in $)? . An investor just purchased a 182 day maturity Treasury bill for 98.375. What is the coupon equivalent yield? . What is the bank discount yield? NA Treasury note with a maturity of eight years and a coupon interest rate of 4.10% was quoted at a price of 103. What is this T-note's yield to maturity? 4. An IBM zero coupon bond with a maturity in September, 2026, has a price of 55. What is the bonds yield to maturity? 5. An Exxon bond (par value = 100) has a maturity of 15 years and a coupon interest rate of 5.8%. If you require a yield to maturity of 6.5% on similar risk bonds, what is the value (price of this bond? 6. A Citigroup zero coupon bond has a maturity of six years and a yield of 7%. Interest rates are expected to increase by 1.5%. Based on duration what price change do you expect for this bond? 7. An ATT bond (100 par value) which matures in exactly three years (September, 2022) has a coupon of 6.8%. The price of the bond is 96.8547. Your required rate of return is 8%. a. What is this bond's modified duration? b. If you expect yields to decrease by 1% (100 basis points), what is the approximate percent price change expected on this ATT bond? c. Compute the actual price change (in percent). FINA46000 - Assignment #1 September, 2019 Answer questions on a separate piece of paper. Show your work 1. A recent listing for a Treasury bill in the Wall Street Journal gave an Asked Discount Yield of 2.10%. Its maturity was 150 days. a. What is the T-bill's coupon (bond) equivalent yield? b. What price would a bank pay for this T-bill? c. What is the effective annual yield for the T-bill? d. If the Bid Discount Yield was 2.25%, what was the dealer's "spread" on the bill (in $)? . An investor just purchased a 182 day maturity Treasury bill for 98.375. What is the coupon equivalent yield? . What is the bank discount yield? NA Treasury note with a maturity of eight years and a coupon interest rate of 4.10% was quoted at a price of 103. What is this T-note's yield to maturity? 4. An IBM zero coupon bond with a maturity in September, 2026, has a price of 55. What is the bonds yield to maturity? 5. An Exxon bond (par value = 100) has a maturity of 15 years and a coupon interest rate of 5.8%. If you require a yield to maturity of 6.5% on similar risk bonds, what is the value (price of this bond? 6. A Citigroup zero coupon bond has a maturity of six years and a yield of 7%. Interest rates are expected to increase by 1.5%. Based on duration what price change do you expect for this bond? 7. An ATT bond (100 par value) which matures in exactly three years (September, 2022) has a coupon of 6.8%. The price of the bond is 96.8547. Your required rate of return is 8%. a. What is this bond's modified duration? b. If you expect yields to decrease by 1% (100 basis points), what is the approximate percent price change expected on this ATT bond? c. Compute the actual price change (in percent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts