Question: please answer question #5. 1) Problem #1: (4 points) Show your work.... Three different projects are being evaluated by ACE, Inc. for potential implementation by

please answer question #5.

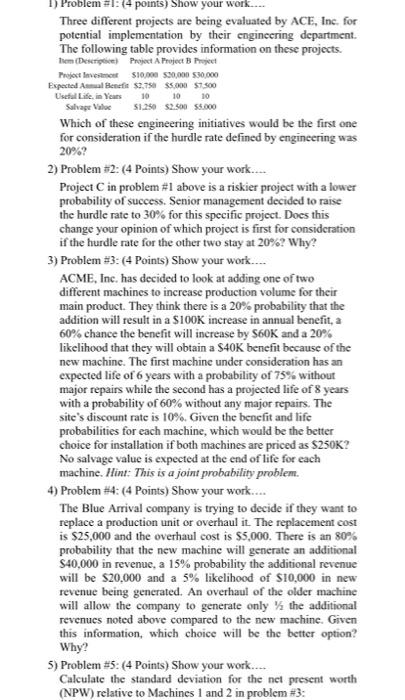

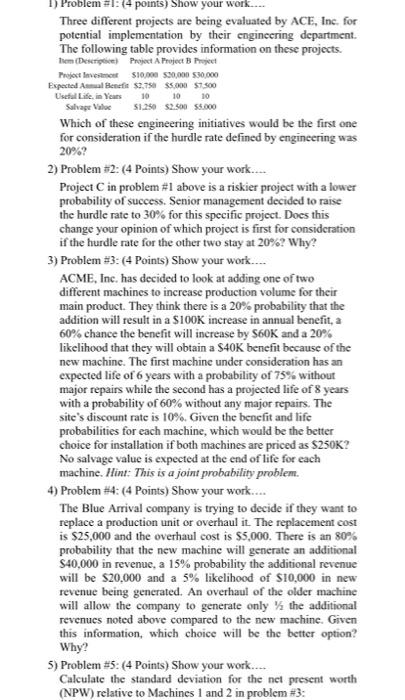

1) Problem #1: (4 points) Show your work.... Three different projects are being evaluated by ACE, Inc. for potential implementation by their engineering department. The following table provides information on these projects. hem (Description Project A Project B Project Project Investment $10,000 $20,000 $30,000 Expected Asal Benefit $2,750 $5,000 $7.500 Useful Life, in Years 10 10 Salvage Value 10 $1,250 $2.500 $5.000 Which of these engineering initiatives would be the first one for consideration if the hurdle rate defined by engineering was 20%? 2) Problem #2: (4 Points) Show your work.... Project C in problem #1 above is a riskier project with a lower probability of success. Senior management decided to raise the hurdle rate to 30% for this specific project. Does this change your opinion of which project is first for consideration if the hurdle rate for the other two stay at 20%? Why? 3) Problem # 3: (4 Points) Show your work.... ACME, Inc. has decided to look at adding one of two different machines to increase production volume for their main product. They think there is a 20% probability that the addition will result in a $100K increase in annual benefit, a 60% chance the benefit will increase by S60K and a 20% likelihood that they will obtain a $40K benefit because of the new machine. The first machine under consideration has an expected life of 6 years with a probability of 75% without major repairs while the second has a projected life of 8 years with a probability of 60% without any major repairs. The site's discount rate is 10%. Given the benefit and life probabilities for each machine, which would be the better choice for installation if both machines are priced as $250K? No salvage value is expected at the end of life for each machine. Hint: This is a joint probability problem. 4) Problem #4: (4 Points) Show your work.... The Blue Arrival company is trying to decide if they want to replace a production unit or overhaul it. The replacement cost is $25,000 and the overhaul cost is $5,000. There is an 80% probability that the new machine will generate an additional $40,000 in revenue, a 15% probability the additional revenue will be $20,000 and a 5% likelihood of $10,000 in new revenue being generated. An overhaul of the older machine will allow the company to generate only the additional revenues noted above compared to the new machine. Given this information, which choice will be the better option? Why? 5) Problem # 5: (4 Points) Show your work.... Calculate the standard deviation for the net present worth (NPW) relative to Machines 1 and 2 in problem #3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock