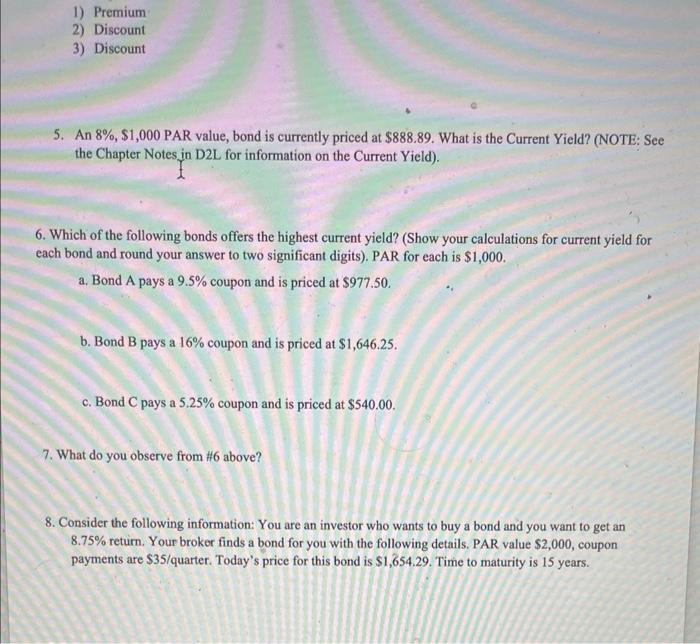

Question: Please answer question 5. 6A,6B, and 6C 1) Premium 2) Discount 3) Discount 5. An 8%,$1,000 PAR value, bond is currently priced at $888.89. What

1) Premium 2) Discount 3) Discount 5. An 8%,$1,000 PAR value, bond is currently priced at $888.89. What is the Current Yield? (NOTE: See the Chapter Notes in D2L for information on the Current Yield). 6. Which of the following bonds offers the highest current yield? (Show your calculations for current yield for each bond and round your answer to two significant digits). PAR for each is $1,000. a. Bond A pays a 9.5% coupon and is priced at $977.50. b. Bond B pays a 16% coupon and is priced at $1,646.25. c. Bond C pays a 5.25% coupon and is priced at $540.00. 7. What do you observe from \#6 above? 8. Consider the following information: You are an investor who wants to buy a bond and you want to get an 8.75% return. Your broker finds a bond for you with the following details. PAR value $2,000, coupon payments are $35 quarter. Today's price for this bond is $1,654.29. Time to maturity is 15 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts