Question: please answer question 5 A New Aircraft Project at Boeing, Inc. Boeing announced the production of a new passenger aircraft in the wake of the

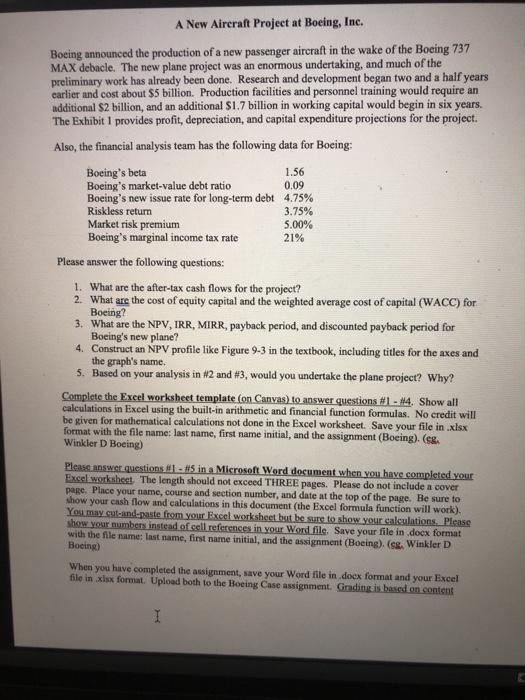

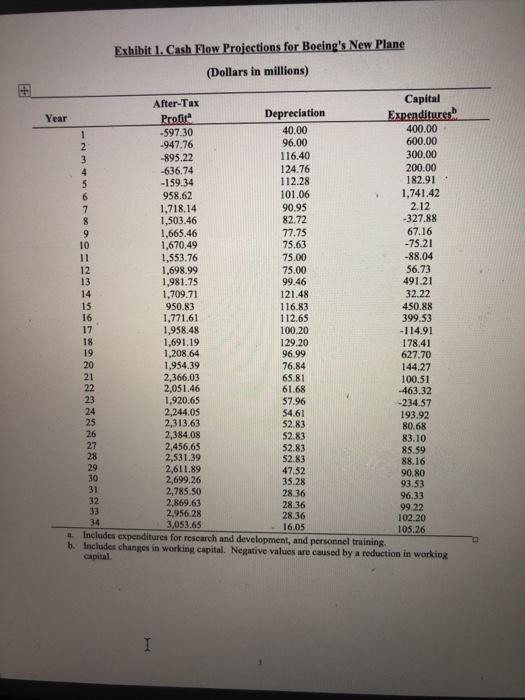

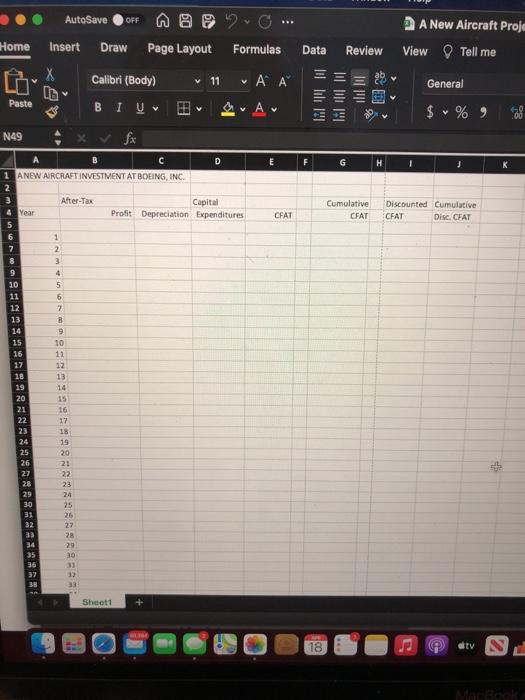

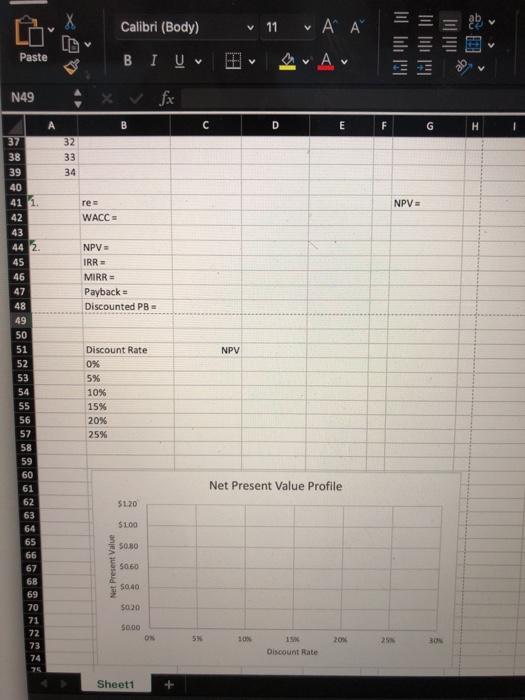

A New Aircraft Project at Boeing, Inc. Boeing announced the production of a new passenger aircraft in the wake of the Boeing 737 MAX debacle. The new plane project was an enormous undertaking, and much of the preliminary work has already been done. Research and development began two and a half years earlier and cost about $5 billion. Production facilities and personnel training would require an additional S2 billion, and an additional $1.7 billion in working capital would begin in six years. The Exhibit I provides profit, depreciation, and capital expenditure projections for the project. Also, the financial analysis team has the following data for Boeing Boeing's beta 1.56 Boeing's market-value debt ratio 0.09 Boeing's new issue rate for long-term debt 4.75% Riskless return 3.75% Market risk premium 5.00% Boeing's marginal income tax rate 21% Please answer the following questions: 1. What are the after-tax cash flows for the project? 2. What are the cost of equity capital and the weighted average cost of capital (WACC) for Boeing? 3. What are the NPV, IRR, MIRR, payback period, and discounted payback period for Boeing's new plane? 4. Construct an NPV profile like Figure 9-3 in the textbook, including titles for the axes and the grapb's name. 5. Based on your analysis in #2 and #3, would you undertake the plane project? Why? Complete the Excel worksheet template (on Canvas) to answer questions #1 - 44. Show all calculations in Excel using the built-in arithmetic and financial function formulas. No credit will be given for mathematical calculations not done in the Excel worksheet. Save your file in .xlsx format with the file name: last name, first name initial, and the assignment (Boeing). (eg. Winkler D Boeing Please answer questions - #5 in a Microsoft Word document when you have completed your Excel workshost. The length should not exceed THREE pages. Please do not include a cover page. Place your name, course and section number, and date at the top of the page. Be sure to show your cash flow and calculations in this document (the Excel formula function will work). You may cut-and-paste from your Excel worksheet but be sure to show your calculations. Please show your numbers instead of cell references in your Word file. Save your file in .docx format with the file name: last name, first name initial, and the assignment (Boeing). (ss. Winkler D Boeing) When you have completed the assignment, save your Word file indoex format and your Excel file in xlsx format. Upload both to the Boeing Case assignment. Grading is based on content I Exhibit 1. Cash Flow Projections for Boeing's New Plane (Dollars in millions) After-Tax Capital Year Profita Depreciation Expenditures 1 -597.30 40.00 400.00 2 -947.76 96.00 600.00 3 -895.22 116.40 300.00 4 -636.74 124.76 200.00 -159.34 112.28 182.91 6 958.62 101.06 1,741.42 7 1,718.14 90.95 2.12 8 1,503.46 82.72 -327.88 9 1.665.46 77.75 7.1 10 1,670,49 75.63 -75.21 11 1,553.76 75.00 -88.04 12 1.698.99 75.00 56.73 13 1,981.75 99.46 491.21 14 1,709.71 121.48 32.22 15 950.83 116.83 450.88 16 1,771.61 112.65 399.53 17 1,958.48 100.20 - 114.91 18 1,691.19 129.20 178.41 19 1,208.64 96.99 627.70 20 1,954.39 76.84 144.27 21 2,366.03 65.81 100.51 22 2,051.46 61.68 -463.32 23 1,920.65 57.96 -234.57 24 2,244.05 54.61 193.92 2,313.63 52.83 80.68 26 2,384.08 52.83 27 83.10 2,456.65 52.83 28 85.59 2,531.39 52.83 88.16 2,611.89 30 47.52 90.80 2,699.26 35.28 93.53 31 2,785.50 28.36 96.33 32 2,869.63 33 28.36 2,956.28 99.22 34 28.36 102.20 3,053.65 16.05 1. Includes expenditures for research and development, and personnel training. 105.26 b. Includes changes in working capital. Negative values are caused by a reduction in working capital AutoSave OFF ". A New Aircraft Proje View Tell me Home Insert Draw Page Layout Formulas Data Review X Calibri (Body) 11 V ab General Paste BIU V A $ % ) N49 D F H 1 A NEW AIRCRAFTINVESTMENT AT BOEING, INC After-Tax Year Capital Profit Depreciation Expenditures CFAT Cumulative CFAT Discounted Cumulative CFAT Disc CFAT 6 7 8 1 2 4 10 5 6 7 B 9 10 11 12 13 14 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 35 36 37 Sheet1 18 C dtv MacBook Calibri (Body) 11 A A Paste BIU N49 B C D E E F G H 32 33 34 res NPV = WACC NPV = IRR MIRR Payback Discounted PB - NPV Discount Rate 0% 5% 10% 37 38 39 40 41 1. 42 43 44 2. 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 15% 20% 25% Net Present Value Profile $1.20 $100 $0.30 Net Present Value 50.60 50.40 $020 50.00 ON 5% 20 2 30 Discount Rate Sheet1 A New Aircraft Project at Boeing, Inc. Boeing announced the production of a new passenger aircraft in the wake of the Boeing 737 MAX debacle. The new plane project was an enormous undertaking, and much of the preliminary work has already been done. Research and development began two and a half years earlier and cost about $5 billion. Production facilities and personnel training would require an additional S2 billion, and an additional $1.7 billion in working capital would begin in six years. The Exhibit I provides profit, depreciation, and capital expenditure projections for the project. Also, the financial analysis team has the following data for Boeing Boeing's beta 1.56 Boeing's market-value debt ratio 0.09 Boeing's new issue rate for long-term debt 4.75% Riskless return 3.75% Market risk premium 5.00% Boeing's marginal income tax rate 21% Please answer the following questions: 1. What are the after-tax cash flows for the project? 2. What are the cost of equity capital and the weighted average cost of capital (WACC) for Boeing? 3. What are the NPV, IRR, MIRR, payback period, and discounted payback period for Boeing's new plane? 4. Construct an NPV profile like Figure 9-3 in the textbook, including titles for the axes and the grapb's name. 5. Based on your analysis in #2 and #3, would you undertake the plane project? Why? Complete the Excel worksheet template (on Canvas) to answer questions #1 - 44. Show all calculations in Excel using the built-in arithmetic and financial function formulas. No credit will be given for mathematical calculations not done in the Excel worksheet. Save your file in .xlsx format with the file name: last name, first name initial, and the assignment (Boeing). (eg. Winkler D Boeing Please answer questions - #5 in a Microsoft Word document when you have completed your Excel workshost. The length should not exceed THREE pages. Please do not include a cover page. Place your name, course and section number, and date at the top of the page. Be sure to show your cash flow and calculations in this document (the Excel formula function will work). You may cut-and-paste from your Excel worksheet but be sure to show your calculations. Please show your numbers instead of cell references in your Word file. Save your file in .docx format with the file name: last name, first name initial, and the assignment (Boeing). (ss. Winkler D Boeing) When you have completed the assignment, save your Word file indoex format and your Excel file in xlsx format. Upload both to the Boeing Case assignment. Grading is based on content I Exhibit 1. Cash Flow Projections for Boeing's New Plane (Dollars in millions) After-Tax Capital Year Profita Depreciation Expenditures 1 -597.30 40.00 400.00 2 -947.76 96.00 600.00 3 -895.22 116.40 300.00 4 -636.74 124.76 200.00 -159.34 112.28 182.91 6 958.62 101.06 1,741.42 7 1,718.14 90.95 2.12 8 1,503.46 82.72 -327.88 9 1.665.46 77.75 7.1 10 1,670,49 75.63 -75.21 11 1,553.76 75.00 -88.04 12 1.698.99 75.00 56.73 13 1,981.75 99.46 491.21 14 1,709.71 121.48 32.22 15 950.83 116.83 450.88 16 1,771.61 112.65 399.53 17 1,958.48 100.20 - 114.91 18 1,691.19 129.20 178.41 19 1,208.64 96.99 627.70 20 1,954.39 76.84 144.27 21 2,366.03 65.81 100.51 22 2,051.46 61.68 -463.32 23 1,920.65 57.96 -234.57 24 2,244.05 54.61 193.92 2,313.63 52.83 80.68 26 2,384.08 52.83 27 83.10 2,456.65 52.83 28 85.59 2,531.39 52.83 88.16 2,611.89 30 47.52 90.80 2,699.26 35.28 93.53 31 2,785.50 28.36 96.33 32 2,869.63 33 28.36 2,956.28 99.22 34 28.36 102.20 3,053.65 16.05 1. Includes expenditures for research and development, and personnel training. 105.26 b. Includes changes in working capital. Negative values are caused by a reduction in working capital AutoSave OFF ". A New Aircraft Proje View Tell me Home Insert Draw Page Layout Formulas Data Review X Calibri (Body) 11 V ab General Paste BIU V A $ % ) N49 D F H 1 A NEW AIRCRAFTINVESTMENT AT BOEING, INC After-Tax Year Capital Profit Depreciation Expenditures CFAT Cumulative CFAT Discounted Cumulative CFAT Disc CFAT 6 7 8 1 2 4 10 5 6 7 B 9 10 11 12 13 14 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 35 36 37 Sheet1 18 C dtv MacBook Calibri (Body) 11 A A Paste BIU N49 B C D E E F G H 32 33 34 res NPV = WACC NPV = IRR MIRR Payback Discounted PB - NPV Discount Rate 0% 5% 10% 37 38 39 40 41 1. 42 43 44 2. 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 15% 20% 25% Net Present Value Profile $1.20 $100 $0.30 Net Present Value 50.60 50.40 $020 50.00 ON 5% 20 2 30 Discount Rate Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts