Question: Please answer question 5 How should again from the sale of treasury stock be reflected when using the cost method of recording treasury stock transactions?

Please answer question 5

Please answer question 5

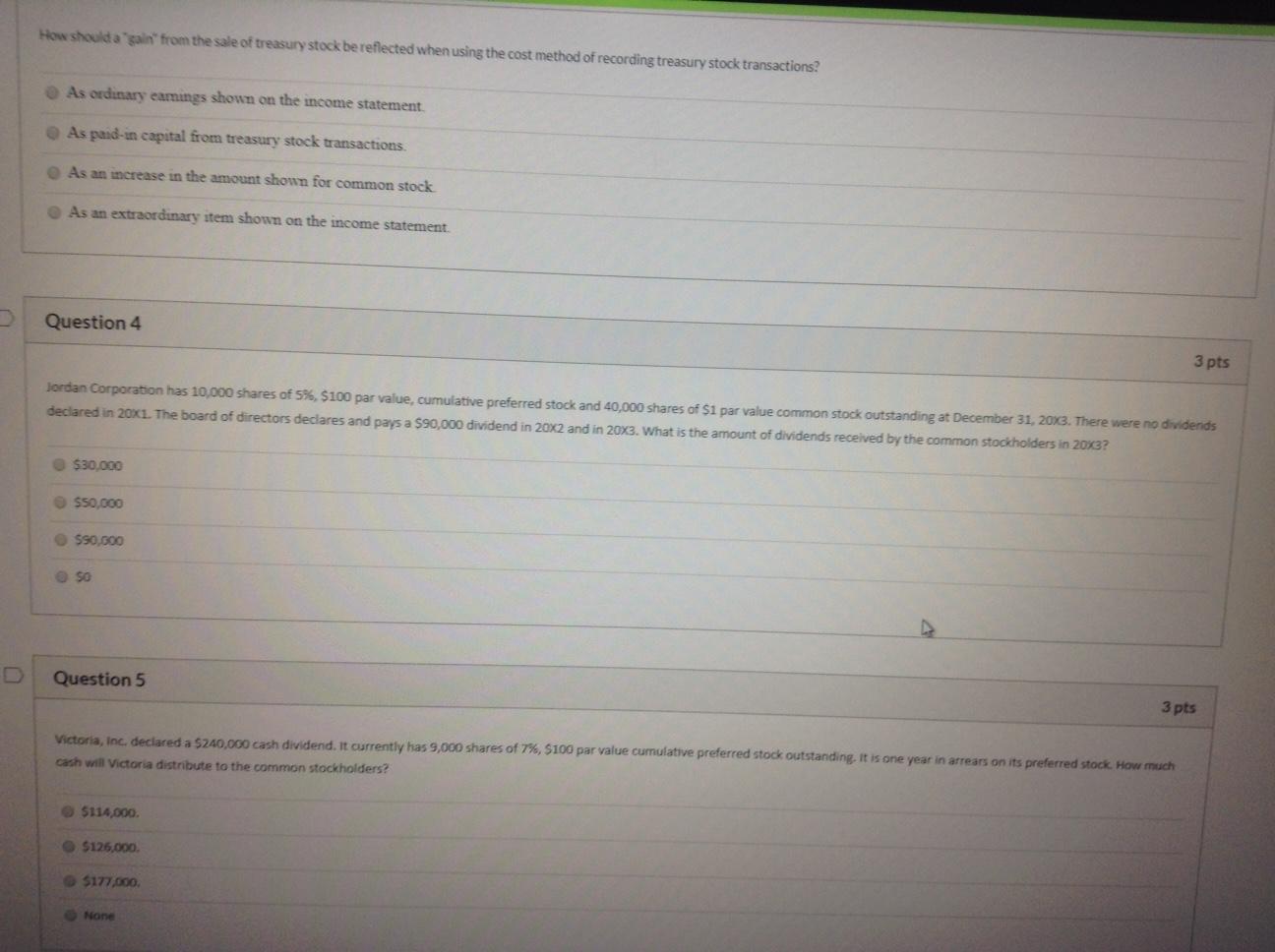

How should again from the sale of treasury stock be reflected when using the cost method of recording treasury stock transactions? As ordinary eamings shown on the income statement As pard-in capital from treasury stock transactions. As an increase in the amount shown for common stock As an extraordinary item shown on the income statement. Question 4 3 pts Jordan Corporation has 10,000 shares of 5%, $100 par value, cumulative preferred stock and 40,000 shares of $1 par value common stock outstanding at December 31, 2013. There were no dividends declared in 20X1. The board of directors declares and pays a $90,000 dividend in 20x2 and in 20X3. What is the amount of dividends received by the common stockholders in 20x3? $30.000 $50,000 $90,000 SO Question 5 3 pts Victoria, Inc. declared a $240,000 cash dividend. It currently has 9,000 shares of 7%, $100 par value cumulative preferred stock outstanding. It is one year in arrears on its preferred stock. How much cash will Victoria distribute to the common stockholders? $114,000 $125,000 5177.000 None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts