Question: Please Answer Question 5 Part A & B Question 4: Use the following information on liabilities to calculate the weighted average duration for each liability

Please Answer Question 5 Part A & B

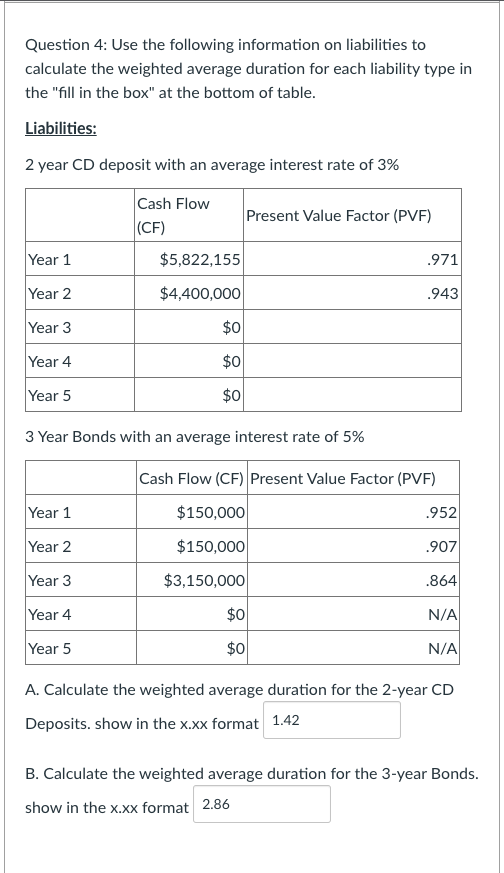

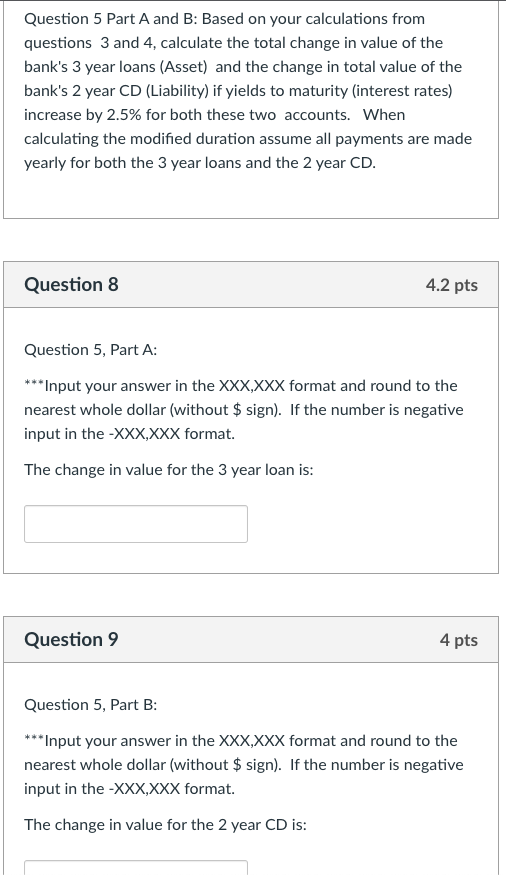

Question 4: Use the following information on liabilities to calculate the weighted average duration for each liability type in the "fill in the box" at the bottom of table. Liabilities: 2 year CD deposit with an average interest rate of 3% 3 Year Bonds with an average interest rate of 5% A. Calculate the weighted average duration for the 2-year CD Deposits. show in the x.xx format B. Calculate the weighted average duration for the 3-year Bonds. show in the x.xx format Question 5 Part A and B: Based on your calculations from questions 3 and 4, calculate the total change in value of the bank's 3 year loans (Asset) and the change in total value of the bank's 2 year CD (Liability) if yields to maturity (interest rates) increase by 2.5% for both these two accounts. When calculating the modified duration assume all payments are made yearly for both the 3 year loans and the 2 year CD. Question 8 4.2 pts Question 5, Part A: Input your answer in the XXX,XXX format and round to the nearest whole dollar (without $ sign). If the number is negative input in the XXX,XXX format. The change in value for the 3 year loan is: Question 9 4 pts Question 5, Part B: Input your answer in the XXX,XXX format and round to the nearest whole dollar (without $ sign). If the number is negative input in the XXX,XXX format. The change in value for the 2 year CD is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts