Question: Please answer question #5 Question 10.4 pollic) Previously correct Questions 3-5. The TecOne Corporation is about to begin producing and selling its prototype product. Annual

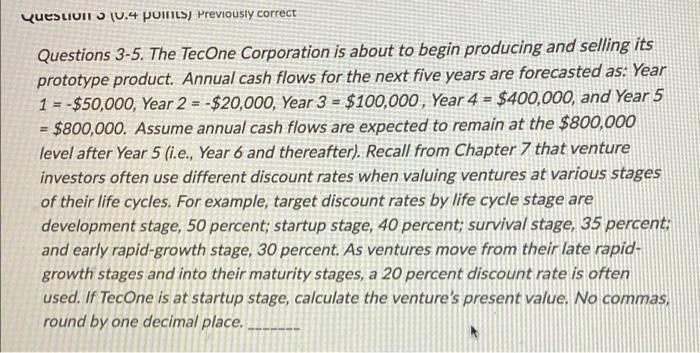

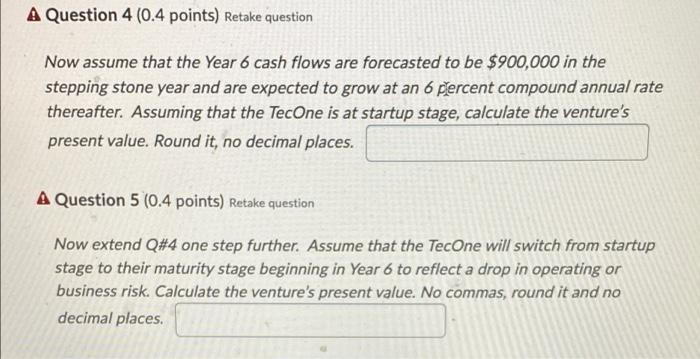

Question 10.4 pollic) Previously correct Questions 3-5. The TecOne Corporation is about to begin producing and selling its prototype product. Annual cash flows for the next five years are forecasted as: Year 1 = -$50,000, Year 2 = -$20,000, Year 3 = $100,000, Year 4 = $400,000, and Year 5 = $800,000. Assume annual cash flows are expected to remain at the $800,000 level after Year 5 (i.e., Year 6 and thereafter). Recall from Chapter 7 that venture investors often use different discount rates when valuing ventures at various stages of their life cycles. For example, target discount rates by life cycle stage are development stage, 50 percent; startup stage, 40 percent; survival stage, 35 percent: and early rapid-growth stage, 30 percent. As ventures move from their late rapid- growth stages and into their maturity stages, a 20 percent discount rate is often used. If TecOne is at startup stage, calculate the venture's present value. No commas, round by one decimal place. A Question 4 (0.4 points) Retake question Now assume that the Year 6 cash flows are forecasted to be $900,000 in the stepping stone year and are expected to grow at an 6 percent compound annual rate thereafter. Assuming that the TecOne is at startup stage, calculate the venture's present value. Round it, no decimal places. A Question 5 (0.4 points) Retake question Now extend Q#4 one step further. Assume that the TecOne will switch from startup stage to their maturity stage beginning in Year 6 to reflect a drop in operating or business risk. Calculate the venture's present value. No commas, round it and no decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts