Question: Please answer question 7 related to question 6 Question 6 Not yet answered Marked out of 1.00 P Flag question Use the given below to

Please answer question 7 related to question 6

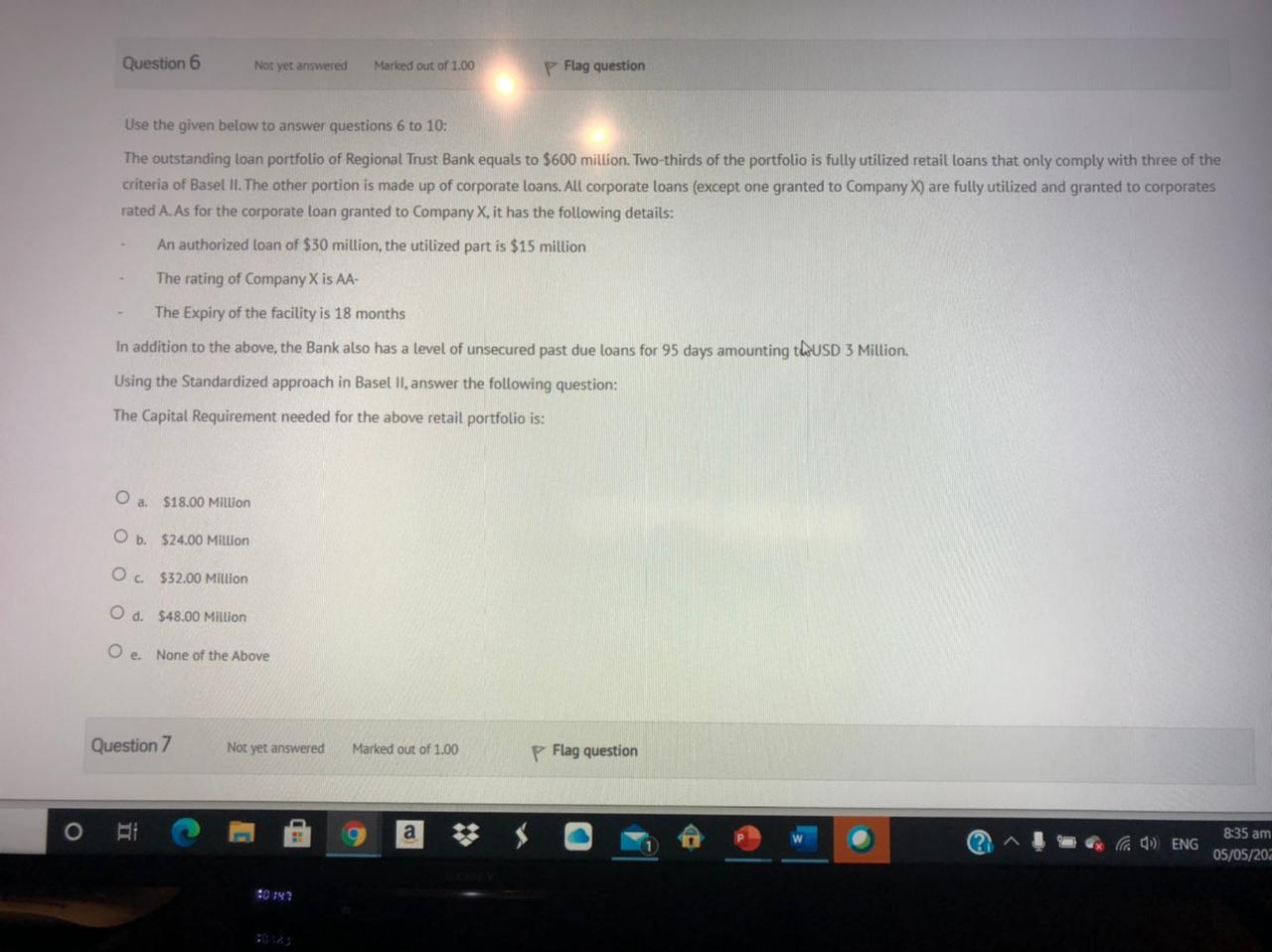

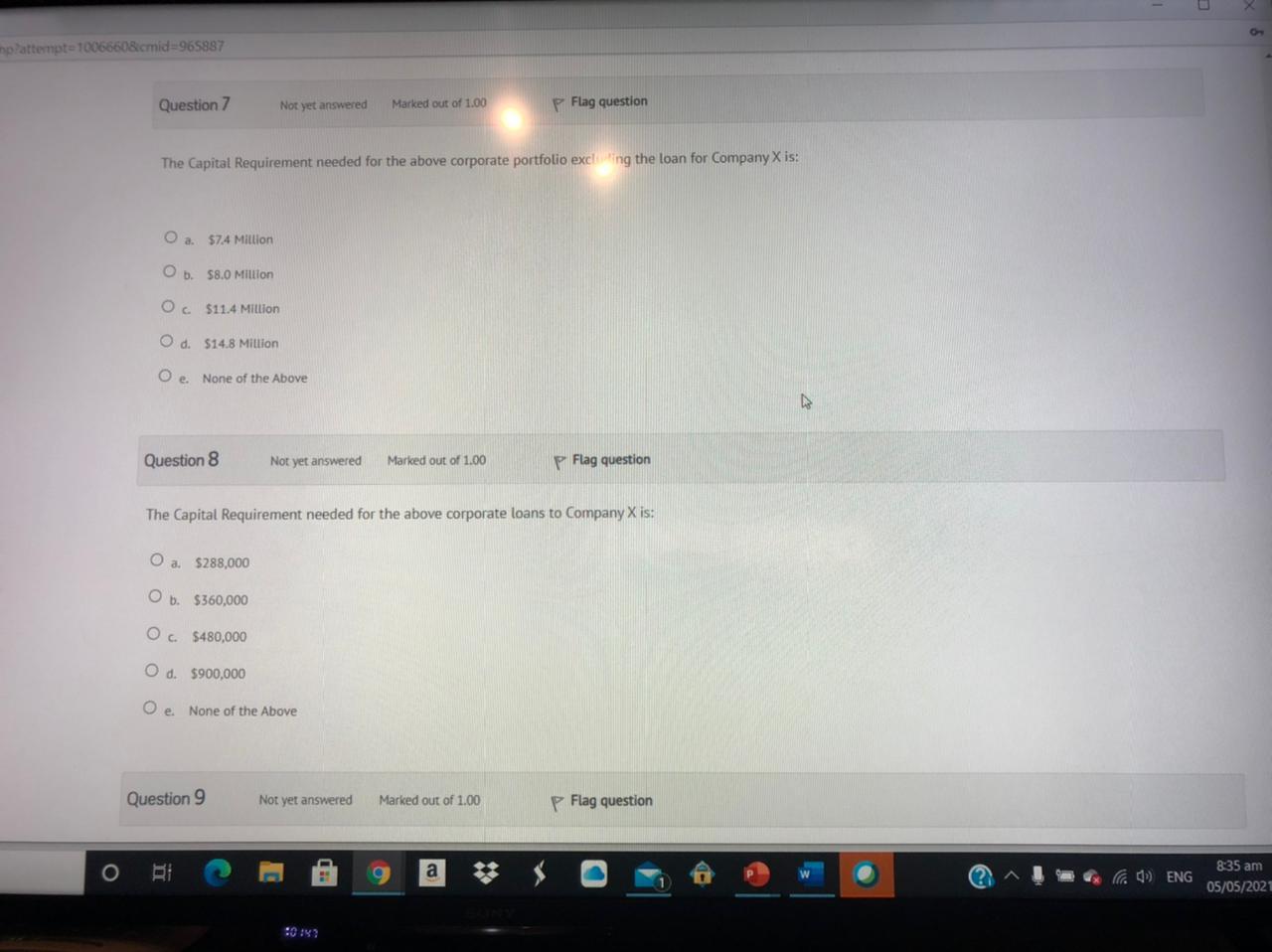

Question 6 Not yet answered Marked out of 1.00 P Flag question Use the given below to answer questions 6 to 10: The outstanding loan portfolio of Regional Trust Bank equals to $600 million. Two-thirds of the portfolio is fully utilized retail loans that only comply with three of the criteria of Basel II. The other portion is made up of corporate loans. All corporate loans (except one granted to Company X) are fully utilized and granted to corporates rated A. As for the corporate loan granted to Company X, it has the following details: An authorized loan of $30 million, the utilized part is $15 million The rating of Company X is AA- The Expiry of the facility is 18 months In addition to the above, the Bank also has a level of unsecured past due loans for 95 days amounting tQUSD 3 Million. Using the Standardized approach in Basel II, answer the following question: The Capital Requirement needed for the above retail portfolio is: O a $18.00 Million O b. $24.00 Million C $32.00 Million Od $48.00 Million O e None of the Above Question 7 Not yet answered Marked out of 1.00 P Flag question o a 0) ENG 8:35 am 05/05/20a 10:47 no attempte 10066608cmid=965887 Question 7 Not yet answered Marked out of 1.00 p Flag question The Capital Requirement needed for the above corporate portfolio excing the loan for Company X is: O a. 574 Million Ob. 58.0 Million Os $11.4 Million O d. $14.8 Million O e None of the Above Question 8 Not yet answered out of 1.00 P Flag question The Capital Requirement needed for the above corporate loans to Company X is: O a $288,000 O b. $360,000 Oc. $480,000 Od $900,000 Oe. None of the Above Question 9 Not yet answered Marked out of 1.00 P Flag question Bi a d) ENG 8:35 am 05/05/2021 ::8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts