Question: Please answer question 8 (e INUL UvuyII MONTIVII 6. A famous anomaly in stock returns is the Post-earnings announcement drift (the PEAD anomaly). The PEAD

Please answer question 8

Please answer question 8

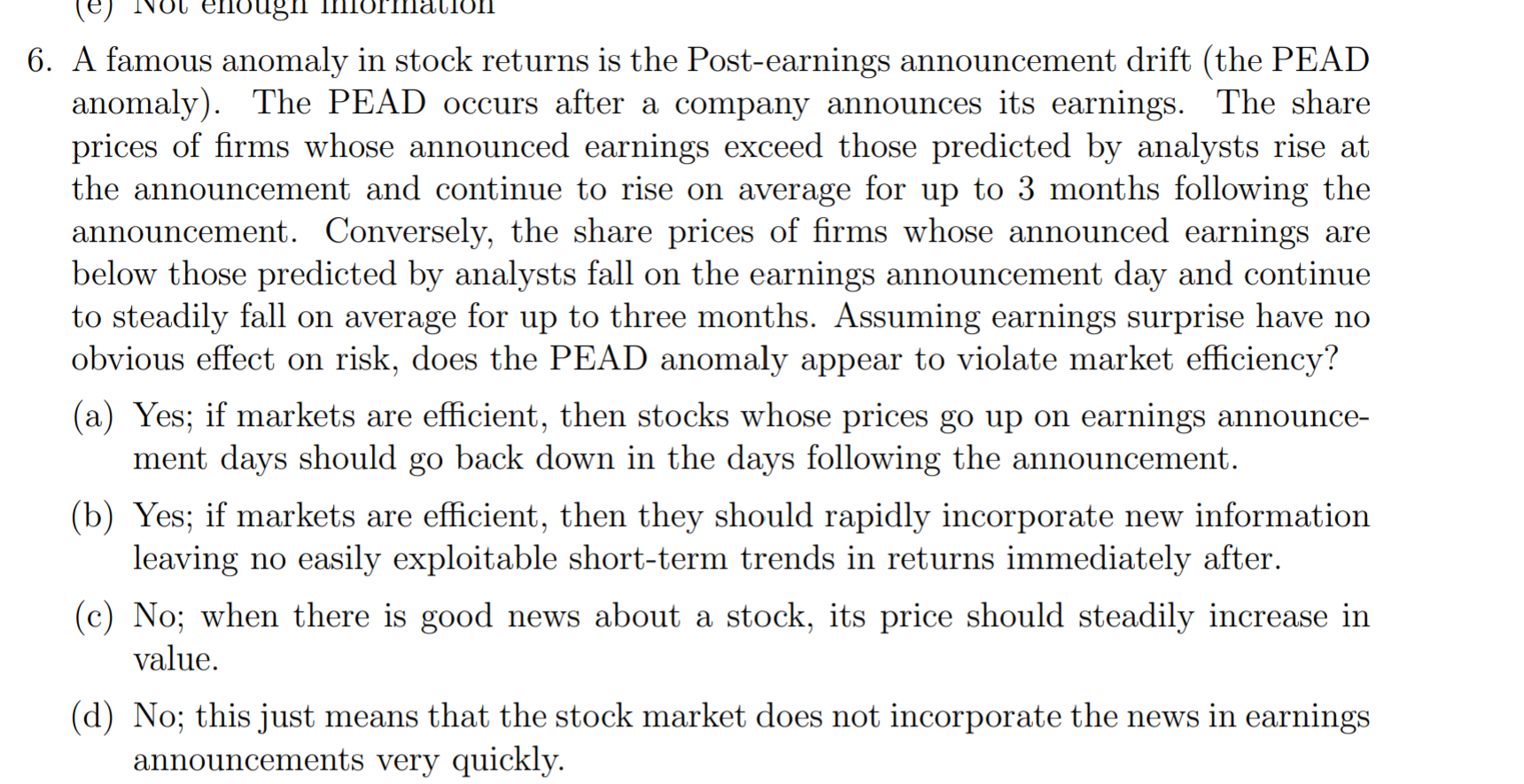

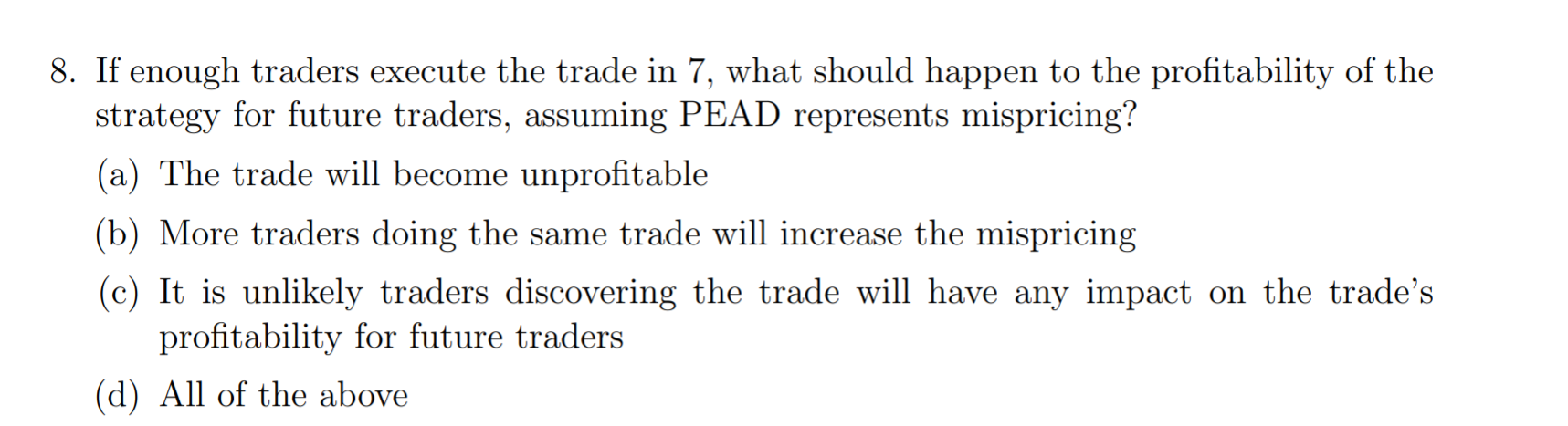

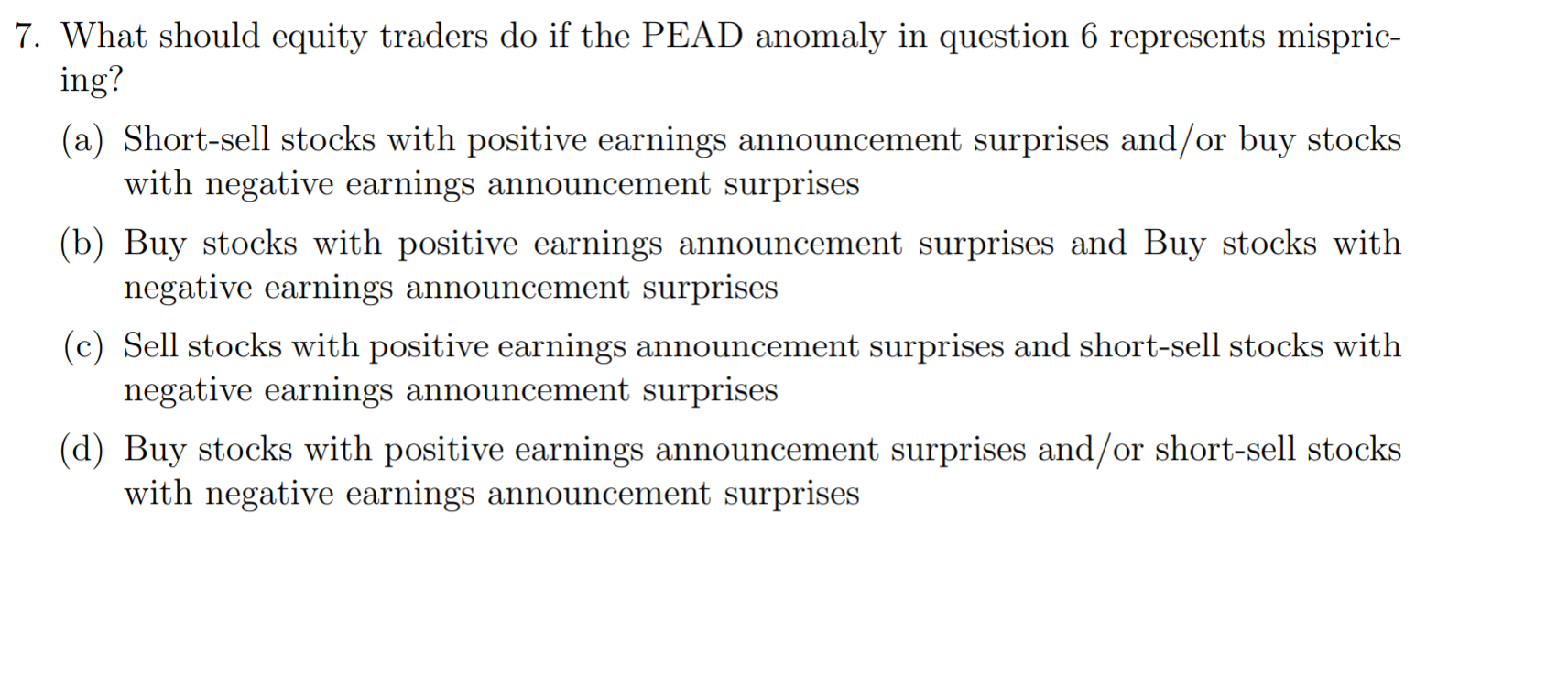

(e INUL UvuyII MONTIVII 6. A famous anomaly in stock returns is the Post-earnings announcement drift (the PEAD anomaly). The PEAD occurs after a company announces its earnings. The share prices of firms whose announced earnings exceed those predicted by analysts rise at the announcement and continue to rise on average for up to 3 months following the announcement. Conversely, the share prices of firms whose announced earnings are below those predicted by analysts fall on the earnings announcement day and continue to steadily fall on average for up to three months. Assuming earnings surprise have no obvious effect on risk, does the PEAD anomaly appear to violate market efficiency? (a) Yes; if markets are efficient, then stocks whose prices go up on earnings announce- ment days should go back down in the days following the announcement. (b) Yes; if markets are efficient, then they should rapidly incorporate new information leaving no easily exploitable short-term trends in returns immediately after. (c) No; when there is good news about a stock, its price should steadily increase in value. (d) No; this just means that the stock market does not incorporate the news in earnings announcements very quickly. 8. If enough traders execute the trade in 7, what should happen to the profitability of the strategy for future traders, assuming PEAD represents mispricing? (a) The trade will become unprofitable (b) More traders doing the same trade will increase the mispricing (c) It is unlikely traders discovering the trade will have any impact on the trade's profitability for future traders (d) All of the above 7. What should equity traders do if the PEAD anomaly in question 6 represents mispric- ing? (a) Short-sell stocks with positive earnings announcement surprises and/or buy stocks with negative earnings announcement surprises (b) Buy stocks with positive earnings announcement surprises and Buy stocks with negative earnings announcement surprises (c) Sell stocks with positive earnings announcement surprises and short-sell stocks with negative earnings announcement surprises (d) Buy stocks with positive earnings announcement surprises and/or short-sell stocks with negative earnings announcement surprises (e INUL UvuyII MONTIVII 6. A famous anomaly in stock returns is the Post-earnings announcement drift (the PEAD anomaly). The PEAD occurs after a company announces its earnings. The share prices of firms whose announced earnings exceed those predicted by analysts rise at the announcement and continue to rise on average for up to 3 months following the announcement. Conversely, the share prices of firms whose announced earnings are below those predicted by analysts fall on the earnings announcement day and continue to steadily fall on average for up to three months. Assuming earnings surprise have no obvious effect on risk, does the PEAD anomaly appear to violate market efficiency? (a) Yes; if markets are efficient, then stocks whose prices go up on earnings announce- ment days should go back down in the days following the announcement. (b) Yes; if markets are efficient, then they should rapidly incorporate new information leaving no easily exploitable short-term trends in returns immediately after. (c) No; when there is good news about a stock, its price should steadily increase in value. (d) No; this just means that the stock market does not incorporate the news in earnings announcements very quickly. 8. If enough traders execute the trade in 7, what should happen to the profitability of the strategy for future traders, assuming PEAD represents mispricing? (a) The trade will become unprofitable (b) More traders doing the same trade will increase the mispricing (c) It is unlikely traders discovering the trade will have any impact on the trade's profitability for future traders (d) All of the above 7. What should equity traders do if the PEAD anomaly in question 6 represents mispric- ing? (a) Short-sell stocks with positive earnings announcement surprises and/or buy stocks with negative earnings announcement surprises (b) Buy stocks with positive earnings announcement surprises and Buy stocks with negative earnings announcement surprises (c) Sell stocks with positive earnings announcement surprises and short-sell stocks with negative earnings announcement surprises (d) Buy stocks with positive earnings announcement surprises and/or short-sell stocks with negative earnings announcement surprises

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts