Question: Please answer question #8. I have already answered the first two questions but need help with #8. I attached the other two because they questions

Please answer question #8. I have already answered the first two questions but need help with #8. I attached the other two because they questions go together!

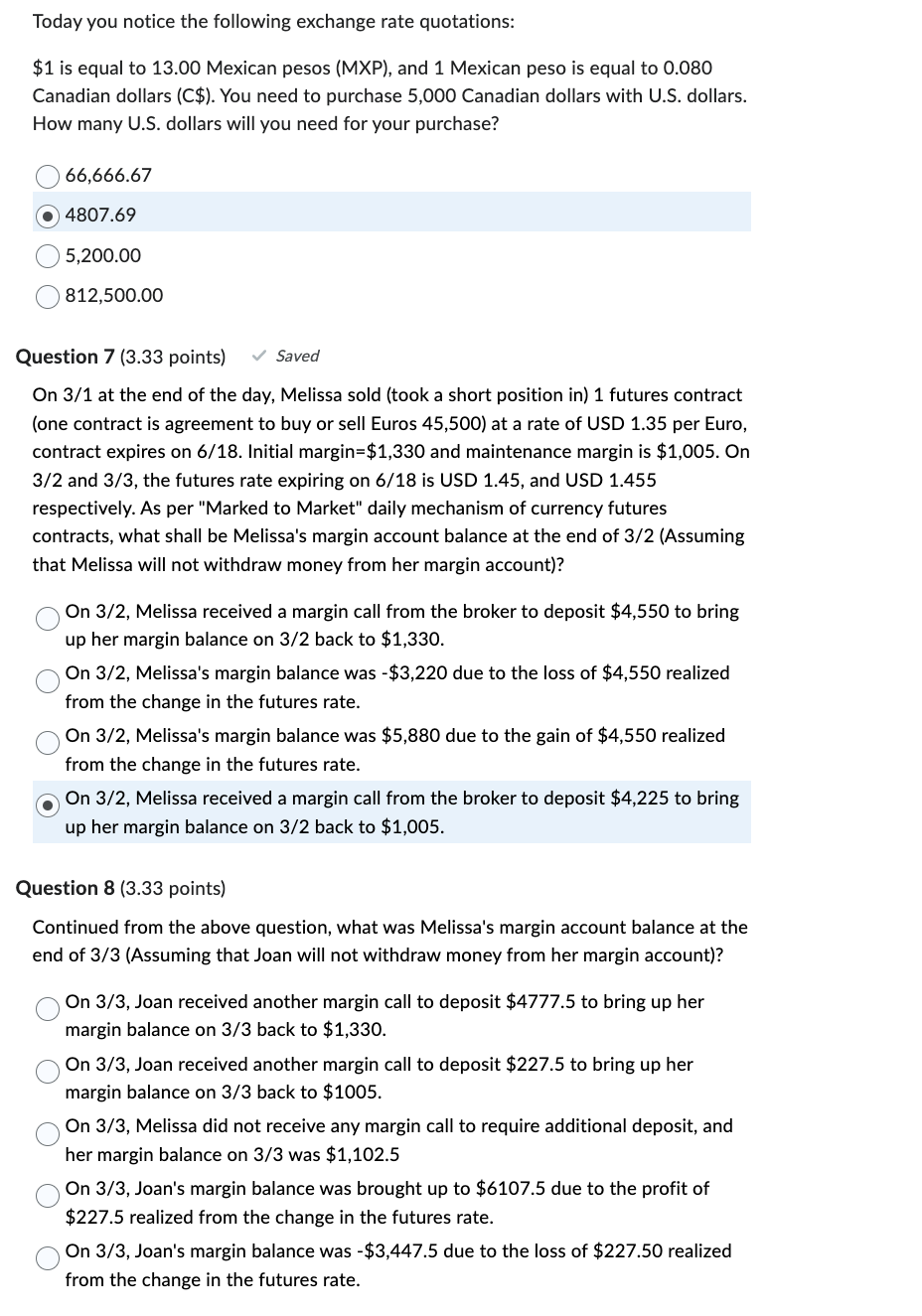

Today you notice the following exchange rate quotations: $1 is equal to 13.00 Mexican pesos (MXP), and 1 Mexican peso is equal to 0.080 Canadian dollars (C\$). You need to purchase 5,000 Canadian dollars with U.S. dollars. How many U.S. dollars will you need for your purchase? 66,666.67 4807.69 5,200.00 812,500.00 Question 7 (3.33 points) Saved On 3/1 at the end of the day, Melissa sold (took a short position in) 1 futures contract (one contract is agreement to buy or sell Euros 45,500) at a rate of USD 1.35 per Euro, contract expires on 6/18. Initial margin= $1,330 and maintenance margin is $1,005. On 3/2 and 3/3, the futures rate expiring on 6/18 is USD 1.45 , and USD 1.455 respectively. As per "Marked to Market" daily mechanism of currency futures contracts, what shall be Melissa's margin account balance at the end of 3/2 (Assuming that Melissa will not withdraw money from her margin account)? On 3/2, Melissa received a margin call from the broker to deposit $4,550 to bring up her margin balance on 3/2 back to $1,330. On 3/2, Melissa's margin balance was $3,220 due to the loss of $4,550 realized from the change in the futures rate. On 3/2, Melissa's margin balance was $5,880 due to the gain of $4,550 realized from the change in the futures rate. On 3/2, Melissa received a margin call from the broker to deposit $4,225 to bring up her margin balance on 3/2 back to $1,005. Question 8 (3.33 points) Continued from the above question, what was Melissa's margin account balance at the end of 3/3 (Assuming that Joan will not withdraw money from her margin account)? On 3/3, Joan received another margin call to deposit $4777.5 to bring up her margin balance on 3/3 back to $1,330. On 3/3, Joan received another margin call to deposit $227.5 to bring up her margin balance on 3/3 back to $1005. On 3/3, Melissa did not receive any margin call to require additional deposit, and her margin balance on 3/3 was $1,102.5 On 3/3, Joan's margin balance was brought up to $6107.5 due to the profit of $227.5 realized from the change in the futures rate. On 3/3, Joan's margin balance was $3,447.5 due to the loss of $227.50 realized from the change in the futures rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts