Question: Please answer question 8 with the provided question . A firm purchased some office equipment for a total cost of $300000. The equipment generated net

Please answer question 8 with the provided question .

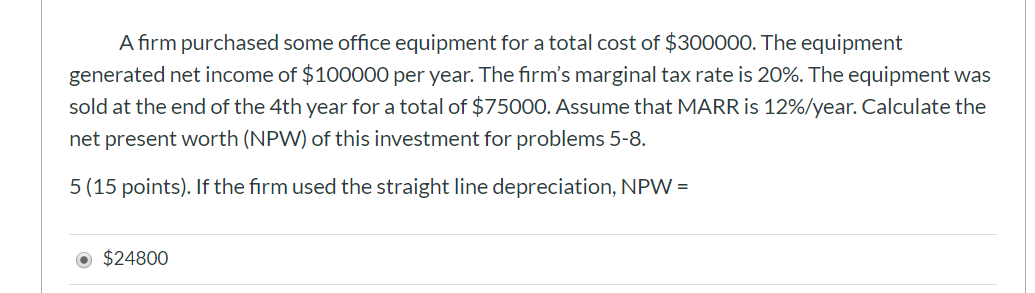

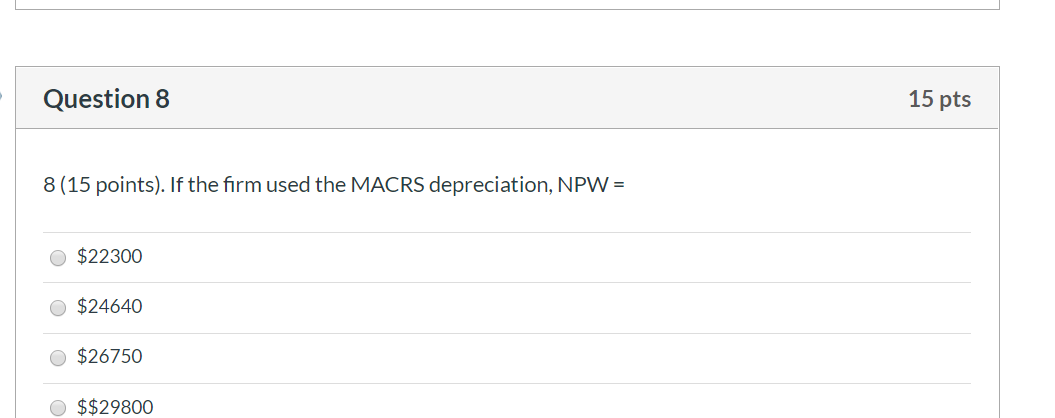

A firm purchased some office equipment for a total cost of $300000. The equipment generated net income of $100000 per year. The firm's marginal tax rate is 20%. The equipment was sold at the end of the 4th year for a total of $75000. Assume that MARR is 12%/year. Calculate the net present worth (NPW) of this investment for problems 5-8. 5(15 points). If the firm used the straight line depreciation, NPW = $24800 Question 8 15 pts 8(15 points). If the firm used the MACRS depreciation, NPW = $22300 $24640 $26750 $ $29800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts