Question: Please answer question 9 only with referring to question 5.((Manually without Using Excel) A company purchased a new Additive Manufacturing machine (3d Printer) for $300K.

Please answer question 9 only with referring to question 5.((Manually without Using Excel)

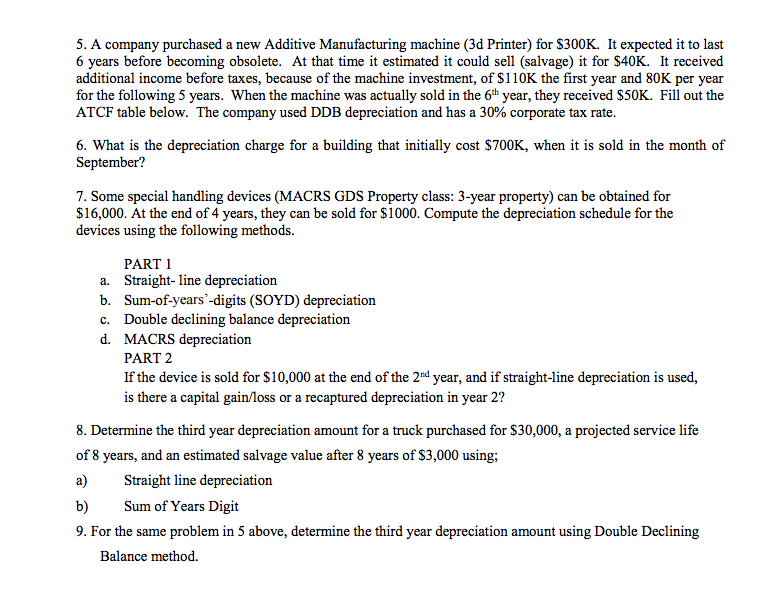

A company purchased a new Additive Manufacturing machine (3d Printer) for $300K. It expected it to last 6 years before becoming obsolete. At that time it estimated it could sell (salvage) it for $40K. It received additional income before taxes, because of the machine investment, of $110k the first year and 80K per year for the following 5 years. When the machine was actually sold in the 6^th year, they received $50K. Fill out the ATCF table below. The company used DDB depreciation and has a 30% corporate tax rate. What is the depreciation charge for a building that initially cost $700K, when it is sold in the month of September? Some special handling devices (MACRS GDS Property class: 3-year property) can be obtained for $16,000. At the end of 4 years, they can be sold for $1000. Compute the depreciation schedule for the devices using the following methods. a. Straight- line depreciation b. Sum-of-year'-digits (SOYD) depreciation c. Double declining balance depreciation d. MACRS depreciation If the device is sold for $10,000 at the end of the 2^nd year, and if straight-line depreciation is used, is there a capital gain/loss or a recaptured depreciation in year 2? Determine the third year depreciation amount for a truck purchased for $30,000, a projected service life of 8 years, and an estimated salvage value after 8 years of $3,000 using; a) Straight line depreciation b) Sum of Years Digit For the same problem in 5 above, determine the third year depreciation amount using Double Declining Balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts