Question: PLEASE ANSWER QUESTION #9 :) QUESTION 8 Real Options B Part 1: You rent office space so you can start a new company. You need

PLEASE ANSWER QUESTION #9 :)

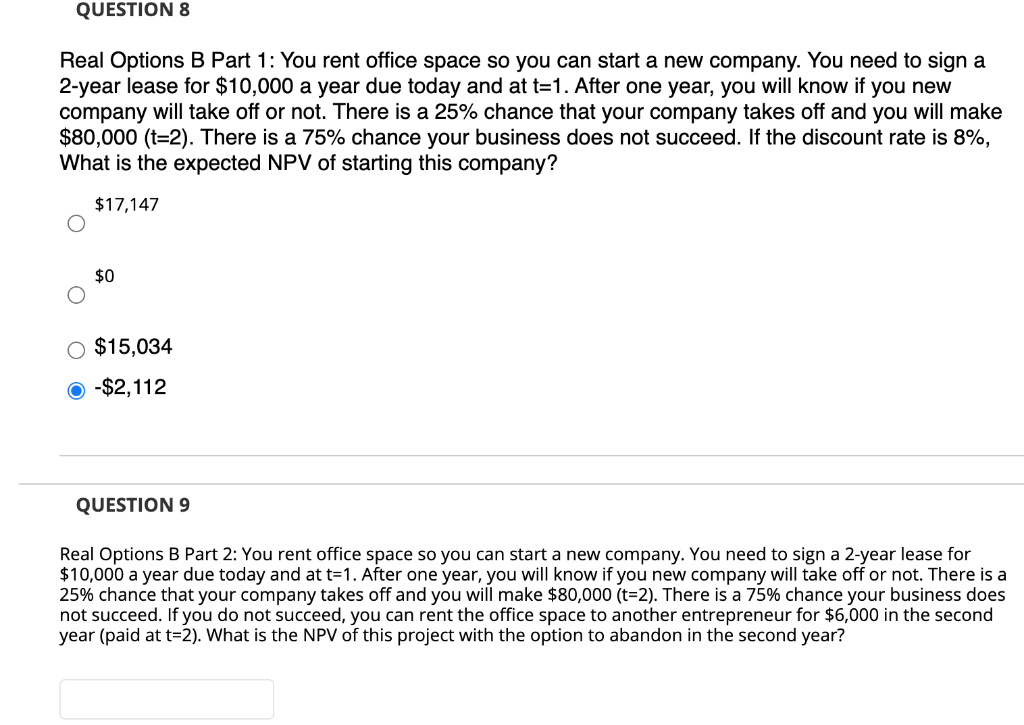

QUESTION 8 Real Options B Part 1: You rent office space so you can start a new company. You need to sign a 2-year lease for $10,000 a year due today and at t=1. After one year, you will know if you new company will take off or not. There is a 25% chance that your company takes off and you will make $80,000 (t=2). There is a 75% chance your business does not succeed. If the discount rate is 8%, What is the expected NPV of starting this company? $17,147 $0 O $15,034 O-$2,112 QUESTION 9 Real Options B Part 2: You rent office space so you can start a new company. You need to sign a 2-year lease for $10,000 a year due today and at t=1. After one year, you will know if you new company will take off or not. There is a 25% chance that your company takes off and you will make $80,000 (t=2). There is a 75% chance your business does not succeed. If you do not succeed, you can rent the office space to another entrepreneur for $6,000 in the second year (paid at t=2). What is the NPV of this project with the option to abandon in the second year? QUESTION 8 Real Options B Part 1: You rent office space so you can start a new company. You need to sign a 2-year lease for $10,000 a year due today and at t=1. After one year, you will know if you new company will take off or not. There is a 25% chance that your company takes off and you will make $80,000 (t=2). There is a 75% chance your business does not succeed. If the discount rate is 8%, What is the expected NPV of starting this company? $17,147 $0 O $15,034 O-$2,112 QUESTION 9 Real Options B Part 2: You rent office space so you can start a new company. You need to sign a 2-year lease for $10,000 a year due today and at t=1. After one year, you will know if you new company will take off or not. There is a 25% chance that your company takes off and you will make $80,000 (t=2). There is a 75% chance your business does not succeed. If you do not succeed, you can rent the office space to another entrepreneur for $6,000 in the second year (paid at t=2). What is the NPV of this project with the option to abandon in the second year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts