Question: please answer question 9 Question 9 3 pts On January 1, 20X3 Madison Company granted 1,000 stock appreciation rights to its key executive. The key

please answer question 9

please answer question 9

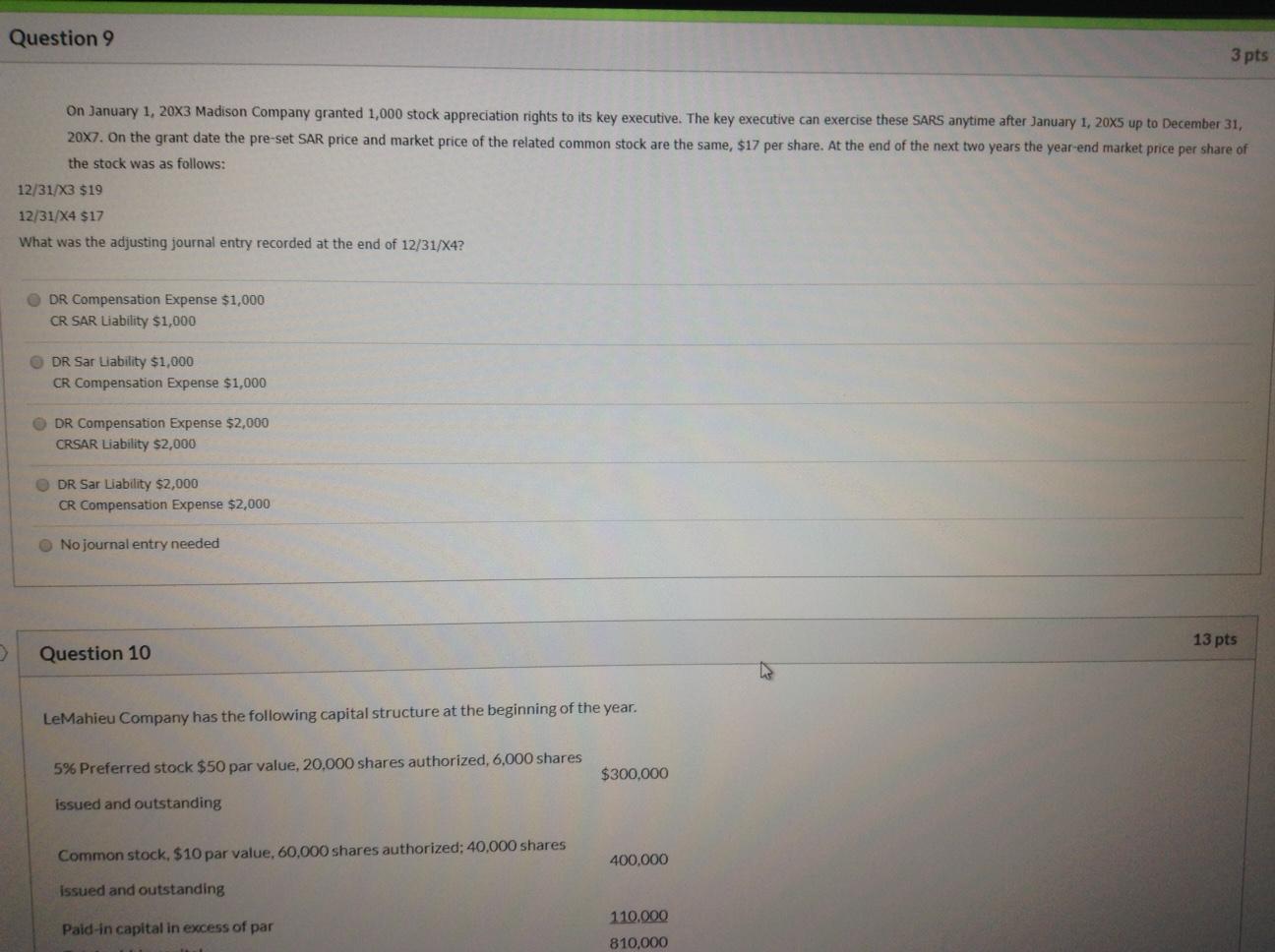

Question 9 3 pts On January 1, 20X3 Madison Company granted 1,000 stock appreciation rights to its key executive. The key executive can exercise these SARS anytime after January 1, 20x5 up to December 31, 20x7. On the grant date the pre-set SAR price and market price of the related common stock are the same, $17 per share. At the end of the next two years the year-end market price per share of the stock was as follows: 12/31/X3 $19 12/31/X4 $17 What was the adjusting journal entry recorded at the end of 12/31/X4? DR Compensation Expense $1,000 CR SAR Liability $1,000 DR Sar Liability $1,000 CR Compensation Expense $1,000 DR Compensation Expense $2,000 CRSAR Liability $2,000 DR Sar Liabdity $2,000 CR Compensation Expense $2,000 No journal entry needed 13 pts > Question 10 LS LeMahieu Company has the following capital structure at the beginning of the year. 5% Preferred stock $50 par value, 20,000 shares authorized, 6,000 shares $300,000 issued and outstanding Common stock, $10 par value, 60,000 shares authorized: 40,000 shares 400,000 issued and outstanding 110.000 Paid-in capital in excess of par 810,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts