Question: Please answer question a , b , c, d... show all work. Thanksl P7-45. ANALYST ADJUSTMENTS 7.1 Reformulating Financial Statements for Warranty Expense Ford Motor

Please answer question a , b , c, d... show all work. Thanksl

Please answer question a , b , c, d... show all work. Thanksl

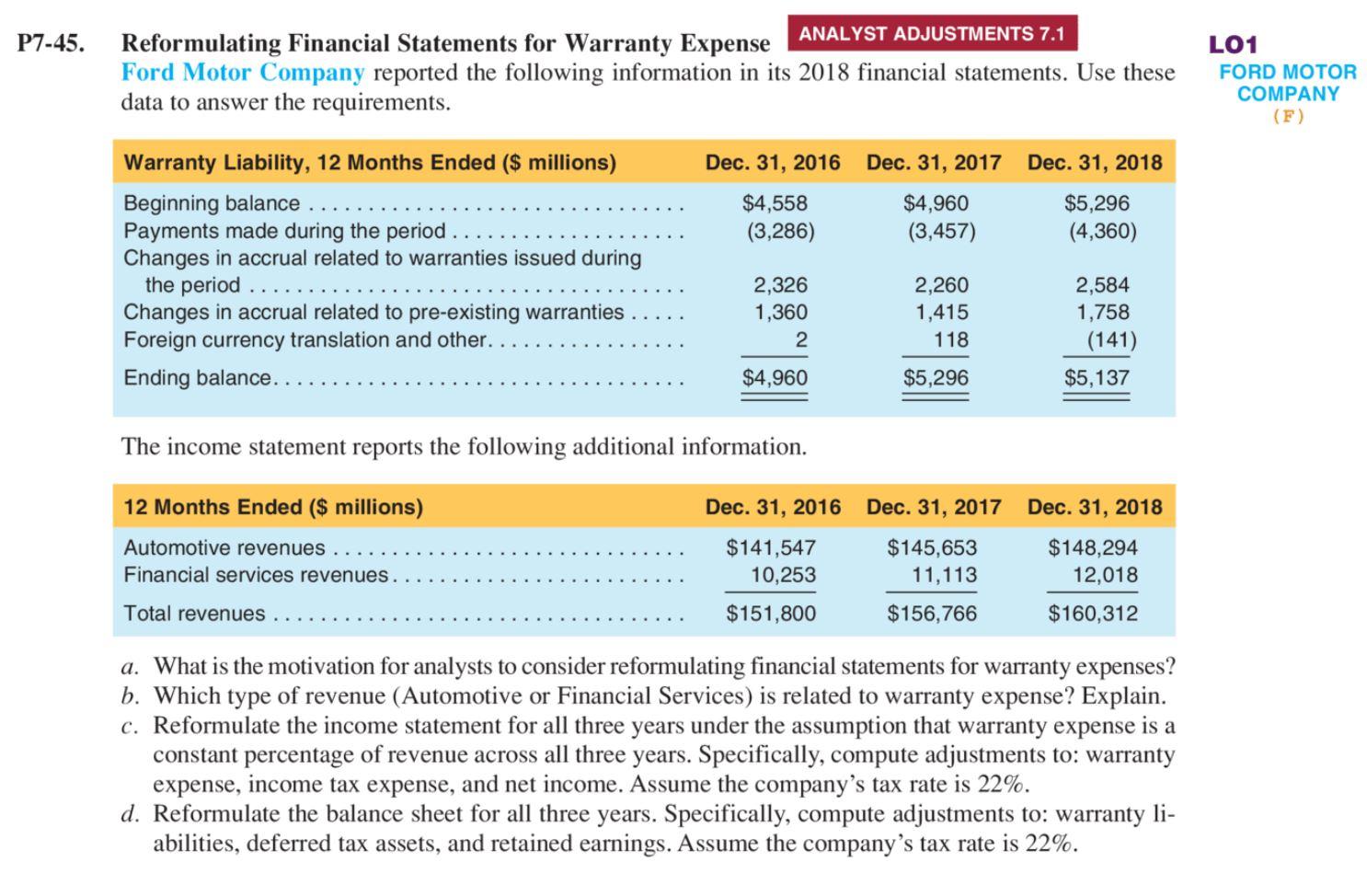

P7-45. ANALYST ADJUSTMENTS 7.1 Reformulating Financial Statements for Warranty Expense Ford Motor Company reported the following information in its 2018 financial statements. Use these data to answer the requirements. LO1 FORD MOTOR COMPANY (F) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 $4,558 (3,286) $4,960 (3,457) $5,296 (4,360) Warranty Liability, 12 Months Ended ($ millions) Beginning balance ... Payments made during the period. Changes in accrual related to warranties issued during the period Changes in accrual related to pre-existing warranties Foreign currency translation and other. Ending balance.. 2,326 1,360 2 2,260 1,415 118 2,584 1,758 (141) $4,960 $5,296 $5,137 The income statement reports the following additional information. Dec. 31, 2018 12 Months Ended ($ millions) Automotive revenues Financial services revenues. Total revenues Dec. 31, 2016 Dec. 31, 2017 $141,547 $145,653 10,253 11,113 $151,800 $156,766 $148,294 12,018 $160,312 a. What is the motivation for analysts to consider reformulating financial statements for warranty expenses? b. Which type of revenue (Automotive or Financial Services) is related to warranty expense? Explain. c. Reformulate the income statement for all three years under the assumption that warranty expense is a constant percentage of revenue across all three years. Specifically, compute adjustments to: warranty expense, income tax expense, and net income. Assume the company's tax rate is 22%. d. Reformulate the balance sheet for all three years. Specifically, compute adjustments to: warranty li- abilities, deferred tax assets, and retained earnings. Assume the company's tax rate is 22%. P7-45. ANALYST ADJUSTMENTS 7.1 Reformulating Financial Statements for Warranty Expense Ford Motor Company reported the following information in its 2018 financial statements. Use these data to answer the requirements. LO1 FORD MOTOR COMPANY (F) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 $4,558 (3,286) $4,960 (3,457) $5,296 (4,360) Warranty Liability, 12 Months Ended ($ millions) Beginning balance ... Payments made during the period. Changes in accrual related to warranties issued during the period Changes in accrual related to pre-existing warranties Foreign currency translation and other. Ending balance.. 2,326 1,360 2 2,260 1,415 118 2,584 1,758 (141) $4,960 $5,296 $5,137 The income statement reports the following additional information. Dec. 31, 2018 12 Months Ended ($ millions) Automotive revenues Financial services revenues. Total revenues Dec. 31, 2016 Dec. 31, 2017 $141,547 $145,653 10,253 11,113 $151,800 $156,766 $148,294 12,018 $160,312 a. What is the motivation for analysts to consider reformulating financial statements for warranty expenses? b. Which type of revenue (Automotive or Financial Services) is related to warranty expense? Explain. c. Reformulate the income statement for all three years under the assumption that warranty expense is a constant percentage of revenue across all three years. Specifically, compute adjustments to: warranty expense, income tax expense, and net income. Assume the company's tax rate is 22%. d. Reformulate the balance sheet for all three years. Specifically, compute adjustments to: warranty li- abilities, deferred tax assets, and retained earnings. Assume the company's tax rate is 22%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts