Question: PLEASE ANSWER QUESTION AND INCLUDE THE STEPS. Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments:

PLEASE ANSWER QUESTION AND INCLUDE THE STEPS.

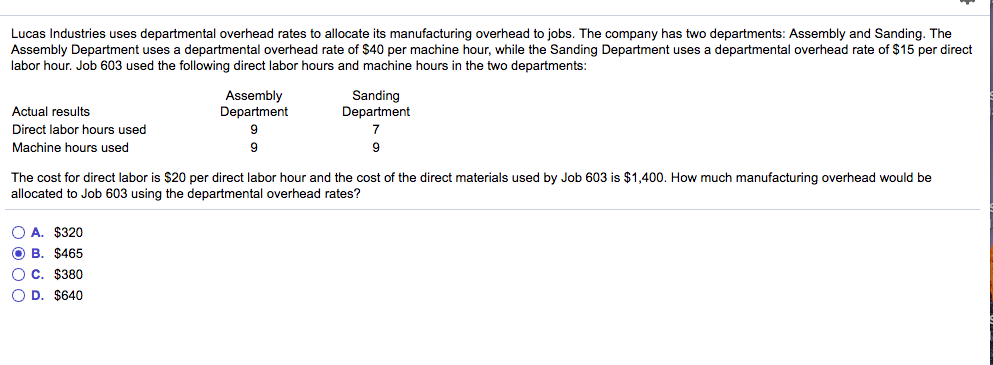

Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $40 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labor hour. Job 603 used the following direct labor hours and machine hours in the two departments Assembly Department Sanding Department Actual results Direct labor hours used Machine hours used The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 603 is $1,400. How much manufacturing overhead would be allocated to Job 603 using the departmental overhead rates? OA. $320 B. $465 OC. $380 O D. $640

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts