Question: Please answer question and show all work! Thanks! 1. Let's say there is a share of stock here. Its price is $10 right now. The

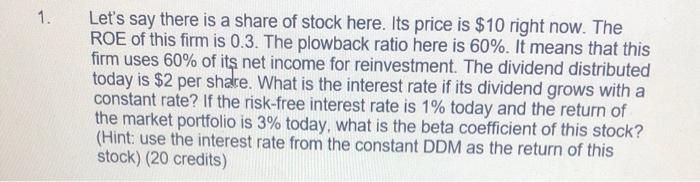

1. Let's say there is a share of stock here. Its price is $10 right now. The ROE of this firm is 0.3. The plowback ratio here is 60%. It means that this firm uses 60% of its net income for reinvestment. The dividend distributed today is $2 per share. What is the interest rate if its dividend grows with a constant rate? If the risk-free interest rate is 1% today and the return of the market portfolio is 3% today, what is the beta coefficient of this stock? (Hint: use the interest rate from the constant DDM as the return of this stock) (20 credits)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts