Question: Please answer question B as question A is 26.17% A year ago, an investor bought 100 shares of a mutual fund at $7.58 per share.

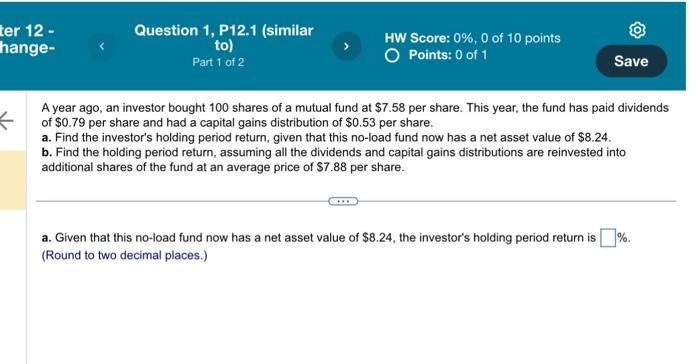

A year ago, an investor bought 100 shares of a mutual fund at $7.58 per share. This year, the fund has paid dividends of $0.79 per share and had a capital gains distribution of $0.53 per share. a. Find the investor's holding period return, given that this no-load fund now has a net asset value of \$8.24. b. Find the holding period return, assuming all the dividends and capital gains distributions are reinvested into additional shares of the fund at an average price of $7.88 per share. a. Given that this no-load fund now has a net asset value of $8.24, the investor's holding period return is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts