Question: Please answer question B QUESTION 2 (10 MARKS) A company is evaluating a loss control plan. The costs and benefits are as follows: The initial

Please answer question B

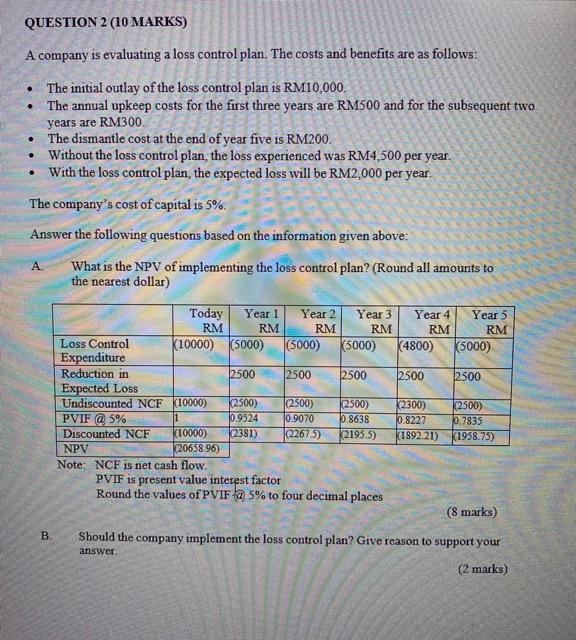

QUESTION 2 (10 MARKS) A company is evaluating a loss control plan. The costs and benefits are as follows: The initial outlay of the loss control plan is RM10,000. The annual upkeep costs for the first three years are RM500 and for the subsequent two years are RM300. The dismantle cost at the end of year five is RM200. Without the loss control plan, the loss experienced was RM4,500 per year. With the loss control plan, the expected loss will be RM2,000 per year. The company's cost of capital is 5%. Answer the following questions based on the information given above: A What is the NPV of implementing the loss control plan? (Round all amounts to the nearest dollar) Year 2 Year 3 Year 4 Year 5 Today Year 1 RM RM RM RM RM RM Loss Control Expenditure Reduction in Expected Lossi Undiscounted NCF PVIF @ 5% Discounted NCF NPV Note: NCF is net cash flow. (10000) (5000) (5000) (5000) (4800) (5000) 2500 2500 2500 2500 2500 10000) (2500) (2500) (2500) (2300) (2500) 1 0.9524 0.9070 0.8638 0.8227 0.7835 (2267.5) (2195.5) (1892.21) (1958.75) (10000) (2381) (20658.96) PVIF is present value interest factor Round the values of PVIF @ 5% to four decimal places (8 marks) B. Should the company implement the loss control plan? Give reason to support your answer. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts