Question: please answer question b Suppose a seven-year, $1,000 bond with a 9.93% coupon rate and semiannual coupons is trading with a yield to maturity of

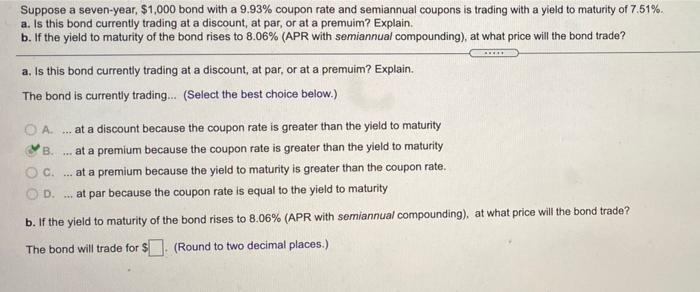

Suppose a seven-year, $1,000 bond with a 9.93% coupon rate and semiannual coupons is trading with a yield to maturity of 7.51%. a. Is this bond currently trading at a discount, at par, or at a premuim? Explain. b. If the yield to maturity of the bond rises to 8.06% (APR with semiannual compounding), at what price will the bond trade? a. Is this bond currently trading at a discount, at par, or at a premuim? Explain. The bond is currently trading... (Select the best choice below.) B. O A ... at a discount because the coupon rate is greater than the yield to maturity at a premium because the coupon rate is greater than the yield to maturity C. ... at a premium because the yield to maturity is greater than the coupon rate. D. ...at par because the coupon rate is equal to the yield to maturity b. If the yield to maturity of the bond rises to 8.06% (APR with semiannual compounding), at what price will the bond trade? The bond will trade for $ (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts