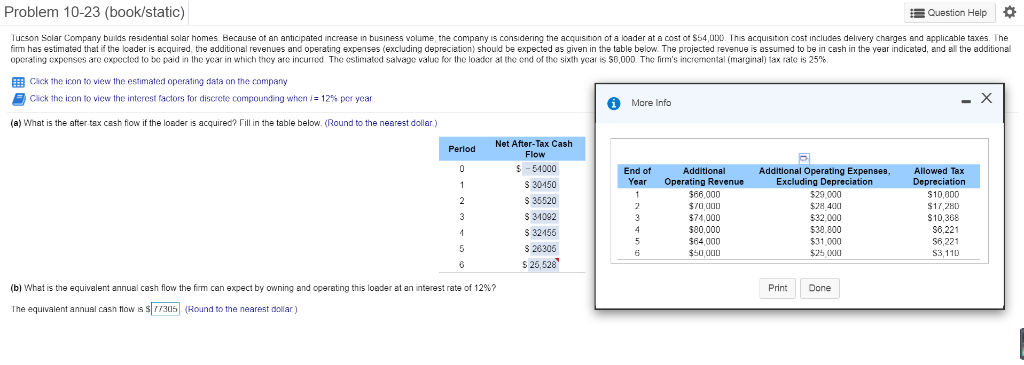

Question: Please answer question b, thank you! Problem 10-23 (book/static) Question Help Tucson Solar Company builds residential solar homes Because ot an anticipated increase in business

Please answer question b, thank you!

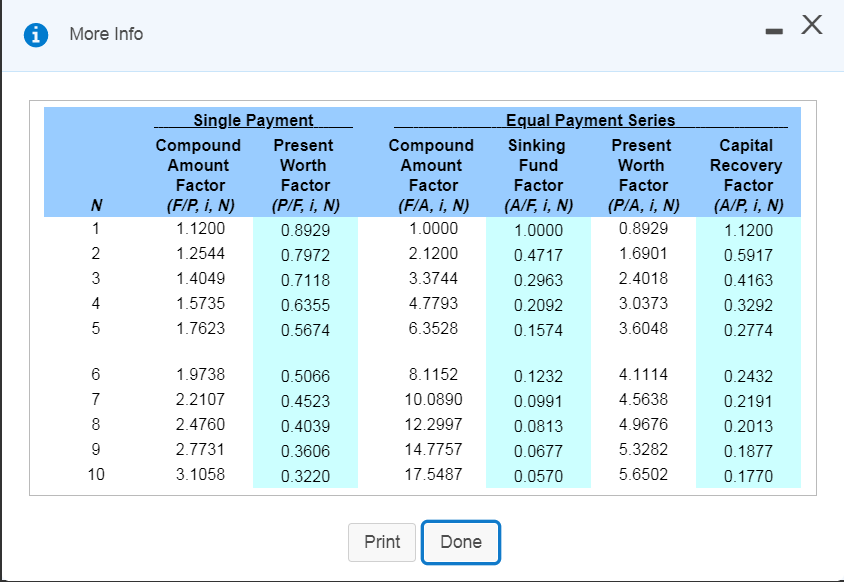

Problem 10-23 (book/static) Question Help Tucson Solar Company builds residential solar homes Because ot an anticipated increase in business volume, the company is considering the acquisition of a loader at a cost of S54,his acquisition cost includes delivery charges and applicable taxes. The firm has estimated that if the loader is acquired, the additional revenues and operating expenses (excluding depreciation) should be expected as given in the table below. The projected revenue is assumed to be in cash in the year indicated, and all the additional operating o po s are c c to be paid the car in which they are incurred The slimat sa ag value or the load a the end of the sixth year s $6,000 The firm s ro ntal marg al tax rate is 25% Cick the icon to view the estimated operating data on the company Cick the icon to view the interest factors for discrete compounding when , 12% per year More Info (a) What is the after tax cash fow if the loeder is acquired? Fill in the table below. (Round to the nearest dollar.) Net After-Tax Cash Flow S - 51000 End of Additional Additional Operating Expenee, Allowed Ta:x Year Operating Revenue S30150 S 35520 S 31092 S 32155 28305 $25,528 $66,000 74,000 80,000 $64,000 50 dOD $29000 $28 410 $32.000 530.800 531,000 $25 000 10,000 $17,280 $10,368 S6,221 $6,221 S3,110 (b) What is tne equivalent annual cash flow the firm can expect by owning and operating this loader at an nterest rate of 12%? Print Done The equivalent annual casn flow s s 77305 (Hound to the nearest dollar) More Info Single Payment Equal Payment SerieS Present Worth Factor (F/P i, N) (P/F i, N) 0.8929 0.7972 0.7118 0.6355 0.5674 Compound Sinking Present Worth Factor (P/A, N) 0.8929 1.6901 2.4018 3.0373 3.6048 Capital Recovery Factor (AP, i, N) 1.1200 0.5917 Compound Amount Factor 1.1200 1.2544 1.4049 1.5735 1.7623 Amount Factor (F/A, N) 1.0000 2.1200 3.3744 4.7793 6.3528 Fund Factor (AF, i, N) 1.0000 0.4717 0.2963 0.2092 0.1574 0.4163 0.3292 0.2774 4.1114 4.5638 4.9676 5.3282 5.6502 1.9738 2.2107 2.4760 2.7731 0.5066 0.4523 0.4039 0.3606 0.3220 8.1152 10.0890 12.2997 14.7757 17.5487 0.1232 0.0991 0.0813 0.0677 0.0570 0.2432 0.2191 0.2013 0.1877 0.1770 3.1058 Print Done Problem 10-23 (book/static) Question Help Tucson Solar Company builds residential solar homes Because ot an anticipated increase in business volume, the company is considering the acquisition of a loader at a cost of S54,his acquisition cost includes delivery charges and applicable taxes. The firm has estimated that if the loader is acquired, the additional revenues and operating expenses (excluding depreciation) should be expected as given in the table below. The projected revenue is assumed to be in cash in the year indicated, and all the additional operating o po s are c c to be paid the car in which they are incurred The slimat sa ag value or the load a the end of the sixth year s $6,000 The firm s ro ntal marg al tax rate is 25% Cick the icon to view the estimated operating data on the company Cick the icon to view the interest factors for discrete compounding when , 12% per year More Info (a) What is the after tax cash fow if the loeder is acquired? Fill in the table below. (Round to the nearest dollar.) Net After-Tax Cash Flow S - 51000 End of Additional Additional Operating Expenee, Allowed Ta:x Year Operating Revenue S30150 S 35520 S 31092 S 32155 28305 $25,528 $66,000 74,000 80,000 $64,000 50 dOD $29000 $28 410 $32.000 530.800 531,000 $25 000 10,000 $17,280 $10,368 S6,221 $6,221 S3,110 (b) What is tne equivalent annual cash flow the firm can expect by owning and operating this loader at an nterest rate of 12%? Print Done The equivalent annual casn flow s s 77305 (Hound to the nearest dollar) More Info Single Payment Equal Payment SerieS Present Worth Factor (F/P i, N) (P/F i, N) 0.8929 0.7972 0.7118 0.6355 0.5674 Compound Sinking Present Worth Factor (P/A, N) 0.8929 1.6901 2.4018 3.0373 3.6048 Capital Recovery Factor (AP, i, N) 1.1200 0.5917 Compound Amount Factor 1.1200 1.2544 1.4049 1.5735 1.7623 Amount Factor (F/A, N) 1.0000 2.1200 3.3744 4.7793 6.3528 Fund Factor (AF, i, N) 1.0000 0.4717 0.2963 0.2092 0.1574 0.4163 0.3292 0.2774 4.1114 4.5638 4.9676 5.3282 5.6502 1.9738 2.2107 2.4760 2.7731 0.5066 0.4523 0.4039 0.3606 0.3220 8.1152 10.0890 12.2997 14.7757 17.5487 0.1232 0.0991 0.0813 0.0677 0.0570 0.2432 0.2191 0.2013 0.1877 0.1770 3.1058 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts