Question: Please answer question b You run a perpetual encabulator machine, which generates revenues averaging $36 million per year. Raw material costs are 50% of revenues.

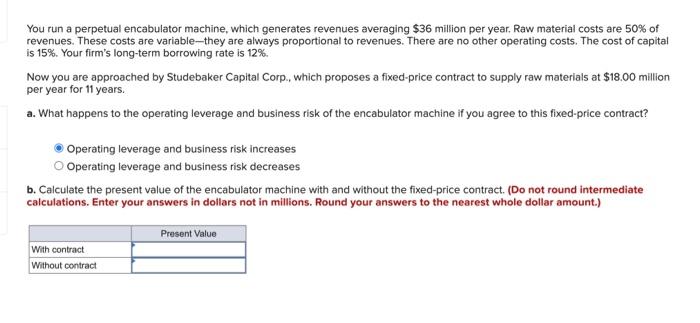

You run a perpetual encabulator machine, which generates revenues averaging $36 million per year. Raw material costs are 50% of revenues. These costs are variable-they are always proportional to revenues. There are no other operating costs. The cost of capital is 15%. Your firm's long-term borrowing rate is 12%. Now you are approached by Studebaker Capital Corp., which proposes a fixed-price contract to supply raw materials at $18.00 million per year for 11 years. a. What happens to the operating leverage and business risk of the encabulator machine if you agree to this fixed-price contract? Operating leverage and business risk increases Operating leverage and business risk decreases b. Calculate the present value of the encabulator machine with and without the fixed-price contract. (Do not round intermediate calculations. Enter your answers in dollars not in millions. Round your answers to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts