Question: Please answer question C, D, E Case Study: K-Viro, Inc. You are Chief Financial Officer at K-Viro, Inc., the leading inventor of the Covid-19 chewable

Please answer question C, D, E

Please answer question C, D, E

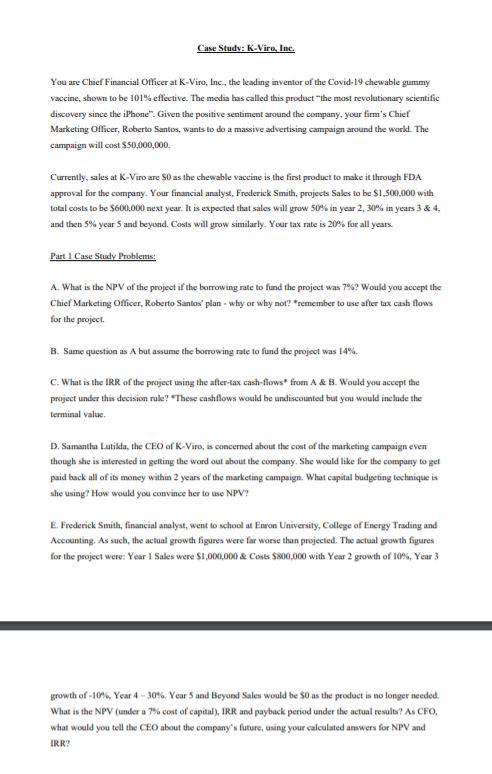

Case Study: K-Viro, Inc. You are Chief Financial Officer at K-Viro, Inc., the leading inventor of the Covid-19 chewable gummy vaccine, shown to be 101% effective. The media has called this product the most revolutionary scientific discovery since the iPhone". Given the positive sentiment around the company, your firm's Chief Marketing Officer, Roberto Santos, wants to do a massive advertising campaign around the work. The campaign will cost $50,000,000 Currently, sales at K-Viro are 80 as the chewable vaccine is the first product to make it through FDA approval for the company. Your financial analyst, Frederick Smith, projects Sales to be $1,500,000 with total casts to be $600,000 next year. It is expected that sales will grow 50% in year 2,39% in years 3 & 4. and then 5% years and beyond. Costs will grow similarly, Your tax rate is 20% for all years Part 1 Case Study Problems A. What is the NPV of the project if the borrowing rate to find the project was 7%? Would you accept the Chief Marketing Officer, Roberto Santos" plan - why or why not? * remember to use after tax cash flows for the project B. Same question as A but assume the borrowing rate to fund the project was 14% C. What is the IRR of the project using the after-tax cash-flows from A & B. Would you accept the project under the decision rule? These cashflows would be undiscounted but you would include the terminal value D. Samantha Lutikla, the CEO of K-Viro, is concerned about the cont of the marketing campaign even though she is interested in getting the word out about the company. She would like for the company to get paid back all of its money within 2 years of the marketing campaign. What capital budgeting technique is she using? How would your convince her to use NPV? E. Frederick Smith, financial analyst, went to school at Eneon University, College of Energy Trading and Accounting. As such, the actual growth figures were for worse thun projected. The actual growth figures for the project were: Year 1 Sales were $1,000,000 & Costs $800,000 with Year 2 growth of 10%, Yeur 3 growth of -10%, Year 4 - 30%. Year 5 and Beyond Sales would be so as the product is no longer needed What is the NPV (under a 7% cost of capital), IRR and payback period under the actual results? As CFO, what would you tell the CEO about the company's future, using your calculated answers for NPV and IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts